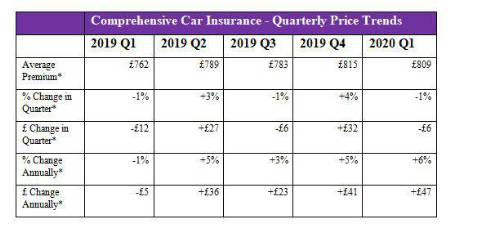

The average cost of car insurance is now £809, following a £47 (6%) increase over the past year, according to the longest established and most comprehensive car insurance price index in the UK, which is based on price data compiled from almost six million customer quotes per quarter.

Source: Willis Towers Watson / Confused.com Car Insurance Price Index. *Values rounded to the nearest whole number.

Graham Wright, UK Lead of P&C Personal Lines Pricing at Willis Towers Watson, commented: “Premium levels for the first quarter have continued to fluctuate monthly with little evidence of an emerging overall trend, which reflects the uncertainties faced by the market and the challenge of balancing conflicting future trends.

“The index data represents a largely pre-Covid period and does not yet give insights into the market’s pricing response to Covid-19, although there is widespread recognition of claim frequency reductions whilst lockdown measures persist and acknowledgement that these may be offset to some degree by severity increases, all of which adds to the uncertainty in the market.”

Drivers in Central and North Wales benefited from the greatest quarterly drop in prices, with their insurance premiums decreasing on average by 3% (£22) to £637. The Scottish Borders and the East Midlands were the two regions in the UK to experience the largest rise in the cost of comprehensive car insurance, with premiums increasing by 2% (£10) and 1% (£11) respectively.

More locally focused data shows that drivers in Salisbury benefited from the greatest quarterly fall of 12% (£82)[2], reducing the premiums of drivers in this area to £600. Drivers in the City of London experienced the sharpest rise of 19% (£218), where drivers were paying an average of £1389 in the last three months. The cheapest town is now Llandrindod Wells, where drivers were paying an average of £550 in the first quarter of 2020 for comprehensive car insurance. East London remains the most expensive place in the UK to buy car insurance, with drivers now paying £1,465.

Male drivers aged 71 or over benefited from the greatest price fall, compared to other age groups, seeing a 4% (£20) quarterly price decrease, taking their annual premiums to £525. Meanwhile, male drivers aged between 26 and 30 experienced the largest price rise of 1% (£8), taking their annual premiums to £1093.

Graham Wright noted: “Notwithstanding the specific impacts of Covid-19 on driving behaviours, the current situation makes future prediction of claims inflation, the timing of the Civil Liabilities Bill implementation and the impact on future reinsurance costs all the more challenging. Given the unprecedented nature of the crisis, we will be aiming to publish an interim index during Q2 to provide an update to the market.”

Steve Fletcher, Head of Data Services at Confused.com comments, “If there’s one thing we know for certain it’s that insurers don’t like uncertainty. There is evidence to suggest that it will be a while before prices calm down and that they will continue on the upward trajectory we’ve seen over the past year and a half.

“While we don’t expect insurers to introduce discounts to account for fewer miles being driven, people are looking to make savings at this financially challenging time. The winners will be the insurers that listen to customer needs and simultaneously react to market movements. Societal uncertainty means insurers will need to closely follow this situation as it unfolds.”

|