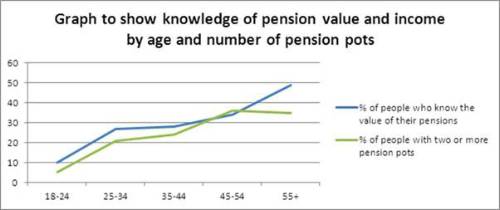

According to recent research from Standard Life, the vast majority of under 45s with pensions are not aware of the total value of their pension pots or the income they can currently expect to receive in retirement.

Only around a quarter (26%) of under 45s with pensions know what their pension pots are currently worth and just one in five (21%) say they know what income they are expecting when they retire. Furthermore, many of them (34%) already have more than one pension pot.

Commenting, Standard Life's Alistair Hardie said:

"Our research shows that most of us don't really know the value of our pension until we are older and in the run up to retirement, despite the fact that we are likely to be receiving annual pension statements. The problem is that by not keeping a close eye on our pensions in the earlier years, we run the risk of falling behind and leaving any top ups until the last minute, when it may be too late to catch up.

"Alongside our homes, our retirement savings are likely to be one of our biggest assets. So by not keeping track of the value of our pension pots and how they are performing, we may be missing out on opportunities to take action and really are leaving ourselves vulnerable at a later age."

Standard Life's research has also found that over two fifths (43%) of people in the UK with pensions have two plans or more, perhaps built up over time as they move jobs. And many of the under 45s (34%) with pensions already have more than one, despite being younger.

Hardie says: "Having multiple pension pots must make it more difficult for people to get a clear picture of the total value - and it could also be why people totally lose touch with their pensions. Consolidating their pots could help and is something to consider.

"When we consolidate our pensions, we have just one provider to keep in touch with and one annual statement to look at and review. Consolidating can also potentially mean we pay lower charges and possibly have more choice and buying power when we come to retire too. For example, pension drawdown is generally not an option if we have a smaller pot, but combining pots could change that. A larger combined pot could also help us find a better rate when we choose an annuity.

"Following the introduction of auto-enrolment, the government is looking at how to ensure that pension pots will follow people as they move around jobs. So in the future, they hope that people won't have this confusion of multiple pension pots. But many people have already built up several different pensions and consolidating some or all of them is something to consider.

"When you think about it, we often consolidate other things like our utility providers or combine our TV, phone and broadband packages with one provider to make things simpler to keep tabs on and generally cheaper too. The same theory could potentially be applied to pension pots. But before consolidating our pensions in one place, we should always check to make sure we are not giving up important benefits, like defined benefits, ‘with profits' bonuses and enhanced tax-free cash and it makes sense to seek professional advice if at all unsure."

|