|

|

By Eugene Dimitriou, Senior Vice President, Account Manager & Berdibek Ahmedov, CFA, Senior Vice President, Product Manager By Eugene Dimitriou, Senior Vice President, Account Manager & Berdibek Ahmedov, CFA, Senior Vice President, Product Manager

Inflation risk exists across virtually all insurance companies’ balance sheets (both for life and non-life providers), as almost all assets are affected directly or indirectly by inflation expectations. Likewise, many insurance liabilities have a direct or indirect inflation link, be it for future administrative expenses or for claims (e.g., payment protection orders, life annuities, medical or legal claims). More importantly, unlike many other market risks insurance companies face, an increase in inflation expectations may cause both sides of the balance sheet to suffer. For example, high inflation may cause asset values to drop while causing liability values to rise.

Quantifying inflation risk

For insurance companies, this risk is difficult to quantify for at least three key reasons: historical misrepresentation, inadequate measurement tools and the challenge of identifying a direct inflation linkage. 1) Recent history lulls us into a false sense of calm Inflation has been on a secular decline since the 1980s and has been very stable over the past 15 to 20 years (see Figure 1). According to the European Central Bank’s (ECB) announcement on 5 June, the central bank clearly suggested that deflation is a far greater worry than inflation, further easing insurers’ concerns. Moreover, equities and nominal bond allocations have outperformed inflation. Thus, insurers have been lulled into a sense of security, perhaps a false one.

FIGURE 1: HIGH AND VOLATILE INFLATION OF THE 1970S HAS GIVEN WAY TO A PROLONGED PERIOD OF LOW AND STABLE INFLATION

While PIMCO sees secular inflation risks anchored around central bank targets, there is still the non-trivial tail risk of inflation exceeding current expectations in the medium to long term. This risk arises from the extremely accommodative monetary policy of many central banks in recent years. Should they succeed in their reflation efforts, to which they remain wholeheartedly committed, we see the potential risk for sudden inflation spikes. Furthermore, there always remains the recurring risk of a sudden spike in commodity prices due to supply-side issues, which could lead to higher inflation levels and, hence, larger insurance liabilities.

2) Lack of adequate measurement tools Inflation is often only indirectly measured by insurance companies. Examples would include implicit assumptions that any inflation trends are highly correlated with expected premium growth or interest rate measures used to discount liabilities, e.g., there are other variables which offset some tail risk inflation scenarios. Indeed, inflation risk is not even directly accounted for under Solvency II (there is no specific inflation stress test). 3) Links to inflation are often difficult to clearly identify Unlike many other market risks, exposure to inflation is often partly obscured for insurance companies. For example, inflation-associated risks may be linked to a specific country or sector (e.g., medical/wages) rather than a more commonly used market benchmark, such as the eurozone’s Harmonised Index of Consumer Prices (HICP). At other times, risks are commingled. For example, longevity or other non-market risks might be commingled, which can complicate and skew the analysis. In some cases, there is a complex interplay between biometric risk and economic variables. An example of insurance liabilities that combines elements of the above is the way regular disability payments (called Payment Protection Orders in the UK) are distributed to a policyholder disabled in an automobile accident. Payments are often annual and are indexed to inflation, but the courts can subsequently vary the payments as circumstances change. Such claims are increasing rapidly in number, size of claim and complexity. For each such claim the insurer has embedded inflation risk but also longevity risk (how long will the policyholder live?), morbidity risk (will the policyholder’s condition improve or worsen?), medical technology risk (new technology may introduce unforeseen expenses or allow the policyholder to regain abilities currently thought to be lost) and legal risk (how will the courts’ thinking evolve regarding insurers’ obligations?), to name but a few hurdles to accurately quantifying the risks. So what should insurers do? By its very nature, inflation risk is misaligned with the insurance cycle. The latter is typically driven by regulatory and legal considerations or the availability of reinsurance capital (which in turn is closely correlated to the quantum and severity of catastrophes). These drivers are unlinked to financial markets. Additionally, insurance regulation typically does not explicitly quantify the required hold capital against inflation. Under Solvency II, insurance companies will be required to identify major sources of risk and, where necessary, create an action plan to address them as part of their Own Risk and Solvency Assessment (ORSA) (a set of processes constituting a tool for decision-making and strategic analysis). While a return to 1970s inflation shocks may appear to be an extreme “stress test”, there is value in considering the impact on liabilities from both a 10% short-term inflation spike and a longer-term trend, where inflation exceeds expectations by 1%. If this analysis suggests an asset-liability mismatch, insurers should investigate further (and, indeed, the ORSA requires them to do so). Such analysis will allow the insurer to identify appropriate assets or hedging instruments. Inflation risk management tools To address this risk, some insurance companies have looked to create real asset buckets in their portfolios to focus on direct (exact) and indirect (more approximate) inflation-hedging assets. Direct inflation hedging For direct inflation hedging, inflation-linked bond (ILB) markets present a viable option to diversify an insurer’s asset portfolio and to hedge liability risk. Today, the ILB market is close to $2.5 trillion and growing at 10%-15% per year, with issuance coming from both existing issuers and new entrants. In parallel, an inflation swap market has developed with reasonable liquidity in the UK Retail Price Index (RPI) and Consumer Price Index (CPI), European Monetary Union (EMU) HICP and French CPI markets. Other single-country CPI swaps trade (German CPI, Spanish CPI, etc) in a comparatively less liquid market than EMU HICP. The ILB and CPI swaps should be the bedrock of a real asset bucket for insurance companies given the contractual linkage to inflation.

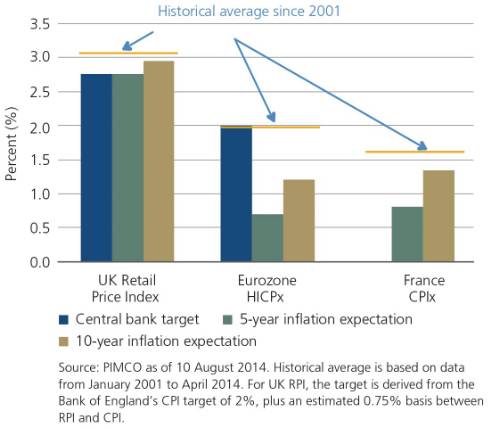

FIGURE 2: HISTORICAL AVERAGE INFLATION, POLICY TARGETS AND MARKET EXPECTATIONS

Market timing is clearly a crucial component in a hedging programme. Unsurprisingly, markets currently appear to price in very modest inflation expectations in the eurozone, well below historical averages and the ECB’s 2% target. Arguably, this backdrop constitutes a good opportunity to lock in modest pricing. Within the UK, historical averages, current Bank of England targets and market expectations appear to be more or less the same (see Figure 2).

Indirect inflation hedging Commodity markets can be effective for indirect inflation hedging. Some insurance companies have invested in oil as a proxy for geopolitical, event and inflation risk. Also, most insurance companies have some exposure to real estate, the total return of which over the long term tends to be positively correlated to inflation. This is due to the lease income on the property, which is often indexed to inflation, and capital appreciation, which is driven by changes in cap rates. Infrastructure debt is worth analysing too, especially where the underlying project has inflation-linked cash flows. What works, and when? In the first instance, it is important to identify assets with positive betas to rising inflation. One can then differentiate between growth-driven inflation (real estate and commodities do better), potential stagflation (ILBs tend to outperform), commodity supply-side-driven inflation (commodities being the obvious pick) and currency debasing/inflation expectations that de-anchor demand-driven inflation (gold and ILBs do better). In principle, this argues for a diversified portfolio of real assets. One can analyse what beta each real asset sleeve is likely to have and design an appropriate strategic real asset mix. Once insurers have decided on a strategic real asset mix, they can apply tactical approaches – based on views about real yields, inflation expectations and some long-term valuations – to capture relative value as the underlying inflation/macro environment evolves. At PIMCO, we currently favour ILBs and Real Estate Investment Trusts (REITs) in our allocations as well as oil, given the positive roll yield. Conversely, we underweight broad commodities with a focus on base metals and agricultural commodities, given the high level of inventories. (For a more in-depth analysis on inflation, read the October 2012 In Depth article by our colleagues Nicholas J. Johnson and Sebastien Page, “Inflation Regime Shifts: Implications for Asset Allocation”.) Key trends amongst insurers Property and casualty insurance companies, whose liabilities tend to be relatively shorter-dated, typically hold their assets in low duration fixed income strategies and may benefit from including an allocation to a basket of short-dated global ILBs, both to diversify their portfolio and to hedge against instances of inflation shocks from the commodity price channel. Crucial here is the lag between premiums being collected and claims being paid (e.g., the longer the time between these two events, the greater the short-term inflation risk) and the ability of insurers to increase premiums subsequent to the initial payment. In instances when inflation risk is explicit and longer-dated (e.g., pension drawdown products are more prevalent among life insurers), it may be more desirable to use inflation swaps for a more precise immunisation of these risks. If there are limitations on trading over-the-counter derivatives, it may be possible to use medium-term notes to implement such exposure. The use of indirect hedges clearly introduces the risk that actual correlations can deviate from expectations, and thus any such approach needs to be evaluated in both business-as-usual and tail risk scenarios. While basis risk cannot be ignored, our analysis suggests that an optimal approach often includes a partial hedge – in addition to precise direct hedges – via shifts in the strategic asset allocation to more inflation-sensitive assets. This would typically be our recommended approach for the auto insurer with disability (PPO) claims discussed earlier. While inflation risk is clearly not at the top of insurance company agendas in Europe, a limited number of back-of-the-envelope calculations ought to allow insurers to identify whether there is a meaningful exposure. If yes, there is a suite of investment and hedging strategies that can potentially be used to mitigate the risks for insurance companies. |

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.