An emergency fund is the money you put aside to cover a financial shock such as a job loss or a large, unexpected expense. It plays an important role in financial planning as the financial cushion prevents people from borrowing money or dipping into other longer-term savings.

In order to build financial resilience, it is important to clear short-term debt, which often carries high rates of interest. The Bank of England’s recent decision to increase interest rates from historic lows could make borrowing even more costly. One in six (16%) adults are looking to pay off short-term debt in 2022, and this is higher amongst Millennials and Generation X.

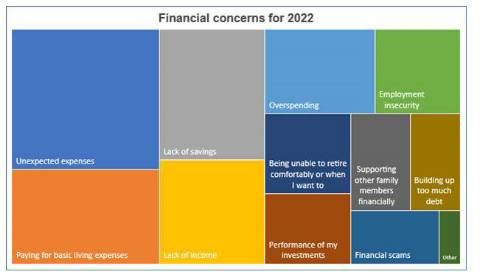

Financial concerns

The research shows the ability to cover an unexpected expense is the top financial concern in the coming year. Overall, 34% of adults said they were concerned about an unexpected financial shock, although worryingly this was higher amongst those over 55 (37%), the group who’ve had the longest to build up financial resilience.

Other top concerns include paying for basic living expenses (23%) followed by a lack of savings (22%).

While some individuals will have saved more during the pandemic as expenditure decreased, others, such as those who have experienced a temporary or permanent decrease in income, will have faced significant financial difficulty. The research highlights that nearly a quarter (23%) of adults whose job was impacted by the pandemic have less money saved than they did pre-pandemic.

Aegon Research: What would you say are your financial concerns for the year ahead (2022)? - 2,000 respondents

Kate Smith, Head of Pensions at Aegon, comments: “It is encouraging that individuals are looking to prioritise building financial resilience in the coming year. While some have managed to save more during the pandemic, others have faced significant financial difficulty, particularly if they have experienced a permanent or temporary fall in income. Some of these will have dipped into their savings to provide short-term relief, but those without a financial safety net could have found themselves exposed as being underprepared to cover any unexpected expense.

“Acknowledging the need to build financial resilience is a good first step but it should be followed by action. A simple way to do this is through budgeting, by mapping your monthly incomings and outgoings and making regular payments to an easily accessible savings fund.

“The general financial uncertainty created by the pandemic has highlighted the importance of financial resilience. Going into a new year with fresh uncertainty surrounding the coronavirus crisis, developing good budgeting skills and savings habits and growing emergency funds will give peace of mind and help to build financial resilience for any future unexpected expense.”

|