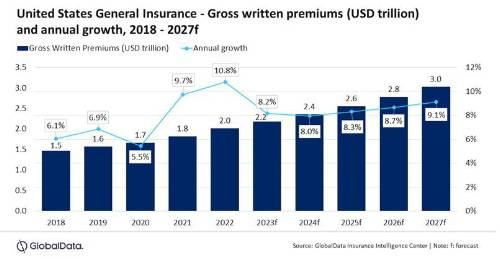

GlobalData’s Insurance Database reveals that the US general insurance industry is expected to grow by 8.2% in 2023 after registering a double-digit growth of 10.8% in 2022. Rising interest rates and persistently high inflation have weighed on consumer spending and narrowed purchasing choices, which is expected to impact general insurance growth in 2023. However, rising premium prices for motor, health, and property insurance policies will support general insurance growth in the US over the next five years.

Sneha Verma, Insurance Analyst at GlobalData, comments: “In the US, premiums for most general insurance business lines have been increasing during the last couple of years. An increase in the number of road accidents as well as the increasing frequency of extreme weather events prompted (re)insurers to reassess their risk exposure. These, along with high inflation, resulted in a rise in reinsurance rates and policy premiums. The price increase is expected to continue over the next few years due to rising medical costs and the increasing frequency of natural catastrophic (nat-cat) events.”

Personal Accident and Health (PA&H) is the leading line in the US general insurance industry and is expected to account for a 53.8% share of the GWP in 2023. Within PA&H insurance, private health insurance is the largest product and is expected to account for 99.9% of the PA&H premiums in 2023, supported by the US federal plans, Medicare and Medicaid that are sold through private insurers in the US.

Verma adds: “Increasing healthcare costs due to inflation, as well as growing demand for health insurance will support PA&H insurance growth, which is expected to grow at a CAGR of 10.7% during 2023-27.”

Motor insurance is the second largest line and is expected to account for 16.4% share of the US general insurance GWP in 2023. Motor vehicle sales grew by 12.6% for the period of January to June 2023 as compared to the same period last year, which will support the growth of motor insurance.

Verma continues: “Motor insurance growth will also be supported by an increase in premium rates. An increase in claims due to climate change-led natural disasters, higher road accidents, and high inflation resulted in a higher cost of claims for insurers. This resulted in motor insurance premiums increasing by 8.4% in 2023 as compared to 1.3% increase in 2022.”

Property insurance is the third largest line, accounting for a 15% share of the general insurance GWP in 2023. It is driven by the demand for nat-cat insurance policies. According to National Centres for Environmental Information (NCEI), the US witnessed an average of 15 natural disasters per year between 2017 and 2022. Due to the increasing frequency of such extreme weather events, the insured losses related to catastrophes increased by 4% in 2022 and stood at $165 billion as compared to $158.2 billion in 2021.

As a result, US property catastrophe reinsurance rates increased by as much as 50% during renewals in July 2023. Property insurance is projected to grow at a CAGR of 5.4% during 2023-27.

Liability, Financial Lines, MAT, and Miscellaneous accounted for the remaining 14.7% of the general insurance GWP in 2023.

Verma concludes: “The US general insurance industry is poised for strong growth over the next five years, driven by growing awareness of health insurance, an increase in vehicle sales, and rising demand for nat-cat insurance. However, higher claims in motor and property lines due to frequent weather events will remain a major challenge for the US general insurers.”

|