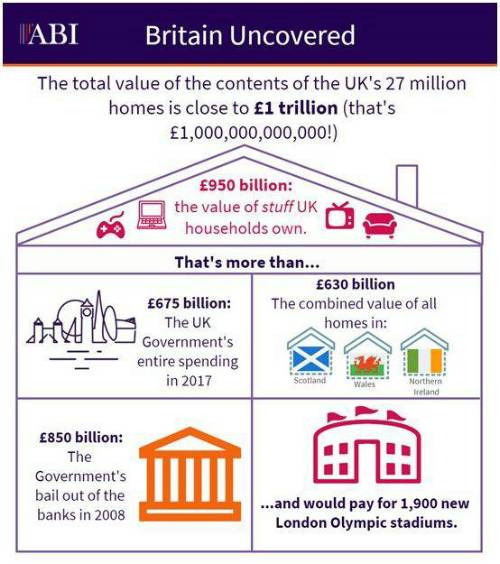

The jaw-dropping value of possessions owned by the UK’s 27 million households, and the amount that is uninsured is laid bare today by the ABI. The value of the UK’s household contents is now nudging towards £1 trillion (one million million: £1,000,000,000,000), with the value of possessions owned by all UK households now worth £9501. billion – that is:

More than central government’s entire spending last year (£675 billion)

More than the combined value of all homes in Scotland, Wales and Northern Ireland (£630 billion)

Eleven times greater than the wealth of the world’s richest man – Jeff Bezos, founder of Amazon (£84 billion).

Greater than the Government bail out of the banks following the financial crisis of 2008 (£850 billion).

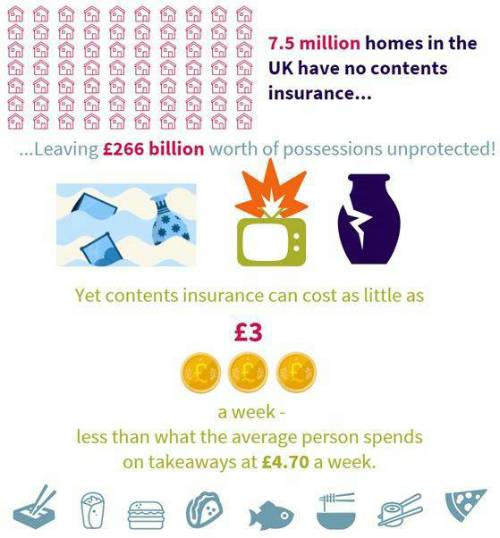

Worryingly, with over a quarter (28%) of households without home contents insurance, this could leave £266 billion worth of possessions uninsured against risks such as theft, fire, flooding and accidental damage. This despite the fact that the average cost of home contents insurance, at £141 a year, works out at less than £3 a week, with the weekly cost of a combined buildings and contents policy less than £6 a week.

These figures will feature in the ABI’s The State of the Market report that will be published at the ABI’s Annual Conference on Tuesday, 27 February.

Mark Shepherd, Head of Property at the ABI, said: “The value of possessions owned by the average household will come as a shock to many. But with the list of ‘must haves’, such as electrical gadgets, ever expanding it can be easy to under-estimate the worth of your contents. These figures further highlight what can be at stake for many who have no contents insurance. With a wide variety of policies available, including no-frills policies tailored to people on limited budgets, insuring your possessions can mean that if the worst happens you are not left counting the cost for years to come.”

“And make sure that when your policy is due for renewal that you review the value of your possessions to ensure that you are adequately covered.”

|