Key findings of the Hymans Robertson “Managing Pension Scheme Risk Report Q2 2011”:

-

The second quarter of 2011 was one of the busiest quarters for the pension scheme risk transfer market since the credit crisis of 2008, with five providers each completing in excess of £150m of risk transfer transactions.

-

The twelve months to 30 June 2011 saw £3.6 billion of risk transfer deals, the vast majority of which were related to buy-ins

-

One of the largest buy-ins during the quarter makes use of an innovative deal structure, involving an escrow account designed to capture improved pricing for CPI inflation-linked liabilities if the CPI pricing market develops in the future.

-

Prudential again signal their intentions in this market with the largest deal in Q2 of £280m.

-

Nomura is the latest investment bank to enter the risk transfer market, recruiting a leading risk transfer pension consultant to drive forward their proposition.

-

Friends Life looks set to become the latest traditional insurer to enter the bulk annuity market, in a further illustration of the strength of demand from pension schemes to transfer their risks.

-

Several potentially significant longevity swap deals have reached exclusivity stage, and Hymans Robertson fully expects some material longevity swap transactions to complete within the next six months.

-

Insurance companies and banks have taken on the risks associated with around £30bn of pension scheme liabilities since 2006/2007 and is expected to rise to £50bn before the end of 2012.

-

The trend will continue for defined benefit pensions to increasingly be supported by insurance companies and banks rather than traditional asset managers.

-

August’s market turmoil is unlikely to slow the progress of planned longevity risk transfer deals or planned buy-in deals for schemes whose assets were already well hedged to liabilities.

The second quarter of 2011 saw £1.4 billion of risk transfer deals completed, comprising buy-ins, buy-outs and longevity swaps, according to Hymans Robertson, the UK’s leading independent experts in pensions and benefits. This figure represents a near 400% increase in the value of deals completed compared to the previous quarter, and several deals remain in the pipeline for later in the year.

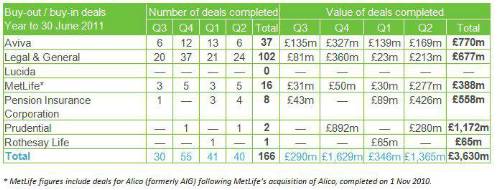

The quarterly “Managing Pension Scheme Risk” report shows that the market for buy-in/buy-outs for the twelve months to 30 June 2011 was dominated by Prudential, Aviva, Legal & General, Pension Insurance Corporation (PIC) and MetLife. Prudential led the field with over 32% of market share, by value, during this period. Given the ever increasing demand from pension schemes to transfer their risks, it was no surprise to see two new entrants – Nomura and Friends Life, enter this market during Q2 2011 as well.

Patrick Bloomfield, Partner and Head of Trustee Solutions, at Hymans Robertson, comments:

“The second quarter saw a buoyant return to activity in the pension risk transfer market after a quieter start to the year. The entry of new providers also indicates that banks and insurers believe the marketplace will continue to develop strongly.

“The level of activity highlights how several schemes have taken the opportunity to de-risk at what appears to have been an opportune time to do so. Market conditions were favourable throughout the quarter, but have turned dramatically in August’s market turmoil. For schemes that were already significantly de-risked or are looking at hedging longevity risk recent market events are unlikely to be a barrier to a deal. However, for less well hedged schemes trustees and sponsors should consider the full range of asset options, not just insurance solutions, to make sure they achieve the best balance of risk and reward for their scheme.”

Looking ahead for 2011, Patrick Bloomfield added:

“We are likely to see further strong activity across the remainder of the year, particularly with schemes pursuing longevity swaps, several of which are already in the pipeline. Schemes looking to pursue this route will need to ensure they have accurate data on their members’ life expectancy though, in order to ensure they receive a well-priced, suitable arrangement.

“Looking further ahead, we predict schemes will continue to look to de-risk, with one in four FTSE 100 companies completing a deal by the end of 2012. Banks and insurers continue to offer new flexibility to make risk transfers accessible and more affordable to all pension schemes. This will help fuel the market, and we may also see further use of ‘DIY buy-ins’. This involves a scheme combining a longevity swap with an investment strategy that matches the cashflows that the pension scheme is required to pay to its pensioners each year. Given August’s market events we may see the DIY approach being favoured by larger schemes for some time.”

Buy-outs / buy-ins—Deals during Q2 2011

The total value of buy-out and buy-in deals struck in Q2 2011 was £1,365 million (around £3.6 billion during the twelve months to 30 June 2011):

Longevity swaps—Deals during Q2 2011

There were no longevity swap deals struck in Q2 2011, but eight deals which covered liabilities worth around £7.2 billion have been completed since 30 June 2009:

|