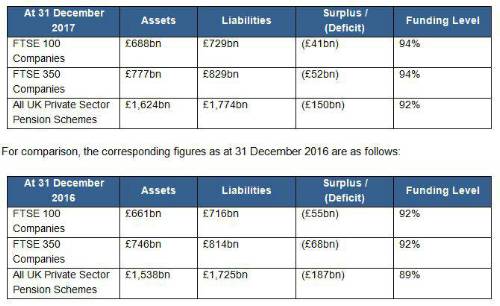

As at 31 December 2017, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Director, JLT Employee Benefits, comments: 2017 was a turbulent year for pension schemes but one with many positives. Markets were strong in the face of considerable political uncertainty and we have, finally, signs that interest rates are on the way up. Additionally, the latest mortality analysis points to a slowing down in the rate of increasing longevity. All of this is good news for pension scheme deficits which have shown some significant improvement over the past year.

As IAS19 deficits are falling, so too are buy-out deficits. At JLT we are seeing strong evidence that the pension buy-out market is showing signs of taking off – as competition between insurers is hotting up and prices are getting keener. With over £12bn of deals transacted in 2017, all the signs point to an even stronger year in 2018, where it is possible that up to £30bn of deals could be transacted.

At the same time we are now seeing some of the UK’s largest pension schemes closing to all future benefits – following the path that smaller pension schemes have been treading right across the private sector for over 10 years now. Tesco, Royal Mail and the Universities Superannuation Scheme have just closed, or are closing their doors, to existing members as well as new members. Combined with the increasing number of DB pension schemes looking to exit entirely through buy-outs, this now means that DB schemes are clearly disappearing from the private sector in the UK. When the regulations came into existence some 12 years ago that saw the creation of the Pension Protection Fund (PPF) there were 7,800 private sector pension schemes covered by the PPF. We have lost nearly one third of these pension schemes and we predict that by 2020 there will be less than 5,000 private sector pension schemes left in the UK.

To pinch a famous quote from Winston Churchill – ‘Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning’. It will still be many years yet before UK plc can afford to settle all of its DB pension liabilities, but we are now clearly on the path to full and final settlement.

|