|

|

New trends data from Admiral Home Insurance shows that despite the ever increasing popularity of gadgets and technology the nation’s most treasured possession in 2018 has been revealed as the family photo album. |

Brits say family photo albums are their most treasured possession;*

68% of home insurance policyholders wouldn’t save their most expensive possession in an emergency

18-24 year olds consider books a top 5 treasured possession Two thirds of policyholders admit they didn’t precisely calculate the value of their home contents when they took out their last policy 36% have NEVER worked out what their home contents are worth Londoners estimate their possessions to be worth 191% more than the Welsh

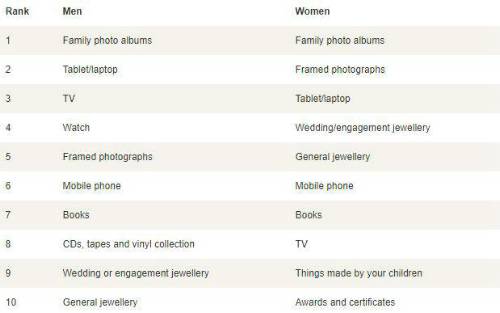

But there’s a gender divide when men and women were asked to choose which of the items they own they considered a treasured possession.Women chose framed photographs as their second most treasured possession with men opting for tablets and laptops followed by TVs, attaching more importance to technology than sentimental items.

Men were also more likely to consider their watch or music collection as something they treasure whereas women valued presents made by their children and certificates above their music collection

Our top 10 most treasured possessions

Survey participants were asked which single item they would save in the event of a disaster with photographs, jewellery, watches and technology including tablets/laptops, TVs and mobile phones the most common items named by all age groups.

When it came to picking an item to save, the genders aligned and were unanimous on the top four things they would protect from harm, however women opted to save framed photographs above their music collection which men selected as the fifth most popular item they would save in a disaster.

The one item we would save in a disaster:

There were differences between the possessions different generations value. When it came to 18-24 year olds, books were listed as their 5th most treasured possession, showing the younger generation isn’t all about technology.

For 25-34-year olds, awards and certificates were identified as the 5th most popular treasured possession, while four times more people in this age group would save their audio equipment than any other age group.

Meanwhile twice as many 35-44 year olds said they would save their scrapbooks than any other age group, and double the number of 65-year old treasured photographic equipment than any other age group.

Only 32% said the single item they would choose to save would be their highest value possession meaning that more than two thirds would not rescue their most expensive item in a disaster.

One man’s trash is another man’s treasure

Across the country, our top treasures varied considerably. In London, nearly a third (31%) of home contents policyholders named musical instruments as a treasured possession, more than twice as many as in Wales where just 15% said they considered their musical instruments to be a treasured possession, despite being a nation famed for musical talent.

In Wales, 40% said they treasured awards and certificates , while only 20% of those in Scotland considered them to be treasured possessionsin

Whilst a quarter of Londoners said they considered their bicycle to be a treasured possession, compared with 7% in the South West. Also in London,19% said they valued sports equipment as a treasured possession, compared with none in Yorkshire and Humberside.

When it comes to things made by children, it was policyholders in the North East who hold them in highest regard, with almost a third (30%) saying things made by their kids were treasured. However, twice as many people in the North East also said they’d save their mobile phone in an emergency than any other region.

Twice as many people in East Anglia and Scotland said they’d save memorabilia if there was a disaster compared with anywhere else, and 50% more people in East Anglia said they’d save a diary or journal compared with anywhere else in the UK. In Scotland, more than twice as many policyholders said they’d choose to save the artwork in their home if there was a disaster. East Midlands and East Anglia were the only areas where people would save objet’s d’art, while more people in the South East would choose to save clothes.

Twice the number of people in Wales than the next nearest region, would select to save medal and coin collections.

Putting a price on our possessions

Despite having strong feelings about the sentimental value of the items in our homes, over a third (36%) of us admit we’ve never accurately valued all our home contents. The worst culprits are 45-54 year olds, where 42% say they’ve never properly worked it out. Almost half (44%) of 25-34 year olds say they’ve worked it out in the last 1-3 years, whilst a fifth of those aged 65 and above say they haven’t done a proper ‘tot up’ for over 6 years.

Admiral has built a widget to show the regional variations of what we consider our treasured possessions.

Noel Summerfield, head of home insurance at Admiral, said: “Whilst the things we treasure most in our homes may be sentimental items or our favourite gadgets, and not necessarily the most expensive things we own, it’s still vital that consumers protect themselves by having the right level of contents cover, regardless of whether they own or rent their home.

“In the event of theft, or a disaster where a claim needs to be made, being underinsured could make a tough situation even worse, and could make it harder to replace the things you need for your home.”

Top tips for calculating contents cover:

Use a contents calculator to help

Go from room to room and look at everything in it Don’t forget your garden, shed, garage and loft – the average garden can contain up to £5,000 worth of belongings and the average theft from a garden is £1,593 List high value items (over £1,000) on your policy separately Add new high value items to your policy when you buy them, not just when you renew your policy |

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.