Commenting on the news today that plans to give millions of existing pensioners the flexibility to sell their annuities for cash are under serious consideration for next week’s Budget, Hymans Robertson, the independent pensions and risk consultancy, explains how this may work in practice and outlines which retirees it might appeal to.

Chris Noon, Partner at Hymans Robertson, said:

“This will build on the reforms announced in last year’s Budget, extending the same rights to 6 million existing retirees. Undoubtedly this will be an appealing policy to many pensioners who feel trapped in a product they didn’t want to buy.

“However, individuals need to carefully consider giving up their annuities. If you are looking for a guaranteed income to last your life then an annuity makes sense. The new flexibilities means individuals are now faced with a baffling range of choices. There’s a misconception that you’ll be able to draw on your pension scheme like a bank account. Understanding the options is not as straightforward as many people think, both in terms of tax implications and costs.

“From April people will need support from age 55 when they can start taking money from their pensions. They also need it at retirement, when they choose what to do with their pots, and also in retirement. It is crucial people see the impact of withdrawals from their pension schemes – either in relation to understanding when they’ll be able to retire with an income that’s adequate or if they’ll have enough to get in the pot to last until the end of their life – and what levers they can use to get back on track.”

Explaining how this might work for the individual, he added:

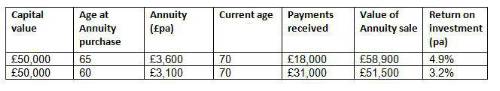

“The table below shows what those in good health with a level, single life annuity (i.e. with no spouse protection), could receive if they were to sell their annuity back to their insurer. This is the true value – in reality administration charges could be levied so the final amount will be less. The shorter the time you’ve held the annuity for, the more you could get. However, individuals need to note they won’t be able to sell their annuity and then buy another one at a better rate. There won’t be scope to ‘work the market’.”

Capital value Age at Annuity purchase Annuity (£pa) Current age Payments received Value of Annuity sale Return on investment (pa)

Commenting on how the market might work, Noon added:

“Creating an open, secondary market for selling on annuities is no small undertaking. The administration of this will be incredibly complex.

“We think it could have similarities to the old endowment policy secondary market, but with much more complexity. The insurer providing the annuity would provide an annuity surrender value, but a secondary market will exist where third parties, for example, other insurers and pension schemes, will compete to buy specific policies.

“The big difference between an annuity and an endowment policy is that the health of the individual has a considerable impact on the value of the annuity. For example, the value of an annuity for a 70 year person with a terminal illness will be substantially less than the value the same annuity for a healthy individual. To allow for this, the market for annuity purchase will need to factor-in underwriting costs.”

|