On the other, George Osborne’s Autumn Statement made it clear that the country faces a prolonged period of  austerity measures, and that reduced tax free allowances for pension savings are among the compromises deemed necessary to steer us back to recovery. austerity measures, and that reduced tax free allowances for pension savings are among the compromises deemed necessary to steer us back to recovery.

Already this year we have seen the publication of CentreForum’s challenging report, Delivering Dilnot: paying for elderly care, with a list of proposals to find the necessary funds to support the UK’s rapidly aging population. Against an economic backdrop still dominated by volatile conditions in the Eurozone and the United States’ flirtation with the fiscal cliff, the future prospects of our senior citizens will increasingly come under the microscope as more of the post-war ‘baby-boom’ generation enter retirement. To put this into perspective, the next decade will see 6.5 million people turning 65 – the equivalent of approximately one tenth of the entire UK population.

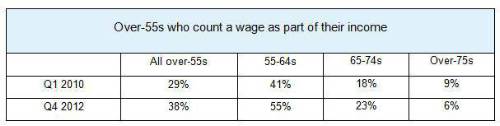

What is especially interesting is that with such numbers reaching the old Default Retirement Age, we are also seeing a substantial shift in the attitudes and actions of the elderly, which has in effect created a ‘new type’ of retiree. Recent research from Aviva’s latest Real Retirement Report has shown that one in four 65 to 74 year olds continues to earn a wage and one in three over-55s plans to work on part-time in retirement to fund and support their quality of life in later years.

As more people enter this age bracket, there will be an increasing importance placed on the role of pensions and other retirement products throughout 2013 and beyond. Greater life expectancy and the longer time many will spend in retirement create a new set of needs and requirements, as people look to stay in their homes for longer and seek out products – such as equity release – that make this possible.

This has been made even more important by the impact of spiralling living costs and the worry that these will be inflated further in the months and years ahead. By way of example, 80% of over-55s said they consider the rising cost of living to be the biggest threat to their lifestyle over the next six months, with 74% taking the same view of the next five years.

In line with these consumer behaviours and concerns, a recent Aviva survey of almost 300 financial advisers in the second half of 2012 showed that 64% anticipate a significant influx of new customers seeking advice on pensions and retirement products to help them plan for later life.

When asked to identify key areas for growing consumer interest, nearly a fifth (17%) of all advisers specifically highlighted equity release. This view was most apparent in advisers aged between 45 and 64, with 21% stating they are confident that interest in equity release products will grow. This suggests that advisers who are facing retirement themselves are even more likely to see the appeal of a range of solutions to help their clients.

The anticipated growth in the equity release market comes as no real surprise as in most cases a home is an individual’s single largest asset. Currently UK homeowners over the age of 55 hold a combined £2 trillion in housing equity, but with more people carrying outstanding mortgage and credit card balances into retirement, debt will form a greater focus for advice than has previously been the case.

In this context, making use of existing property assets through equity release presents a very viable – and often highly appropriate – solution for retirees looking to alleviate either their own financial concerns or those of other family members. Interestingly, 38% of advisers said they already provide advice on equity release, while a further 11% would do so if their clients expressed an interest. What we may also see more of in the coming year, is an increased number of advisers looking to gain further qualifications to advise on these products.

Doing so will help to satisfy the anticipated increase in demand, as among those advisers who do not currently deal with equity release, a lack of appropriate qualifications was highlighted as a significant barrier to entry into the market. Those advisers who choose not to retrain can instead look to build up referral arrangements with a specialist to handle customers’ enquiries about equity release, especially from their existing clientele.

Taking this all into consideration, there seems to be a general consensus among advisers that as the UK population ages, there will be a corresponding increase in the number of people actively seeking guidance about how best to manage their finances in later life, with greater diversification in the retirement products they consider. What is perhaps most encouraging is that this is a long term view, and that advisers expect the trend to continue even after the effects of the Retail Distribution Review (RDR) are fully realised.

With this in mind, 2013 will certainly present advisers with an opportunity to attract substantial levels of new business, strengthen their relationships with existing clients and widen the scope of the advice they are able to offer.

|

By Roger Marsden, Head of Retirement at Aviva

By Roger Marsden, Head of Retirement at Aviva