|

|

By Andrew Epsom, Senior Investment Consultant with Towers Watson

For many insurers the setting of investment strategy needs to be a balancing act that reflects the varying needs of their different stakeholders. But the requirements of shareholders in this respect are often not easily gauged, particularly if there are many different shareholders.

A recent Towers Watson survey of the views of equity analysts on asset allocation principles for property and casualty (P&C) insurers throws some light on the question.These were analysts who specialise in reviewing P&Cinsurers, and work for some of the largest globalequity managers.

The first question was around how much investment risk a P&C insurer should take. All respondents felt that asset allocation was material when deciding whetherto invest in an insurer. However, there was a divergence in views over the level of investment risk.

Around two-thirdsfelt that some degreeof investment risk could in theory be appropriate.However, there was significant qualification of thisstatement, with typical responses such as:

♦ The primary focus should still be on coreunderwriting returns. Insurers who rely too heavilyon investment returns are viewed negatively.

♦ The level of investment risk should be at an acceptable level given the risk inherent inthe liabilities and the expertise available within companies.

♦ There needs to be a strong governance framework to manage investment risk.

There was also recognition that, in the current verylow yield environment, some investment risk might

need to be taken if there is an aspiration to provide returns closer to historical levels.

The remaining one-third stated that taking investmentrisk was not appropriate, and that insurers shouldinstead focus solely on adding value throughunderwriting returns.

Degrees of risk

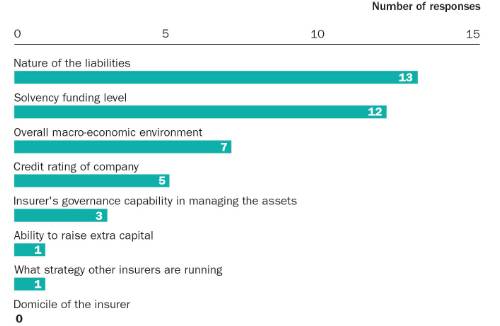

Figure 1 – Which three factors do you consider most important when determining an acceptable level of investment risk for a P&C insurer?

By far the two most important factors that the analysts felt should influence the overall level ofinvestment risk being taken were the nature of theliabilities and the solvency position. Such views are not particularly surprising, but it is worth exploringthe rationale behind them.

The importance attached to the nature of the liabilities backs up the overarching view that the

assets should be there to back the liabilities and underwriting activities, and not act as the primarydriver of return.

The greater the uncertainty in theliabilities, then the lower the level of investment risk.

The solvency positionwas also cited as a major influence on the level ofinvestment risk. Analysts recognised that there wasongoing uncertaintyaround the requirements of Solvency II and alsoacknowledged that even if there was sufficient capitalto support an increased level of investment risk,then it may still be preferable to return capital toshareholders rather than increase risk, depending onstock valuations.

However, Solvency II and the financialcrisis have not fundamentally changedanalysts’ views on investment policies.Although this may appear counter-intuitive, given thechanges taking place,the two main reasons given were:

♦ The investment policy of P&C insurers is alreadygenerally conservative.

♦ Many insurers already maintain economic models of their business, so in practice thereshould be little change.

Equity analysts however did feel thatSolvency II would encourage a more structured risk

management approach for the allocation of capital, potentially forcing a more rigorous debate around investment risk and where this risk is taken within the assets.

Investment characteristics

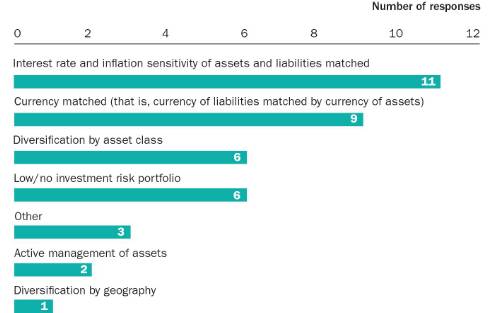

Figure 2 – Which three investment characteristics are most attractive for P&C insurance portfolios

As for the nature of the risks taken, the two factors that analysts felt were mostimportant were matching the assets to the liabilities(by term, inflation linkage and currency) as much aspossible, and diversifying the assets (betweenasset classes and by geography).

Some respondents saw liability matching as the only objective of an investment strategy, to enable management to focus onprimarily managing and improving underwritingreturns. The matching of liabilities was felt to beespecially important for the longer-tailed businesslines where there was potentially greater durationand inflation risk, and more value from betterstructuring the assets.

There was also support for diversifying assetexposure between asset classes and countries orregions. Some cited examples ofwhere, in their view, P&C insurers’ strategies had not beensufficiently well diversified,such as an over-concentration in one product area or large exposureto Eurozone government bonds.

Equally, some analysts questioned theeffectiveness of diversification, noting thatcorrelations have tended to increase duringextreme adverse events.While the available investment risk budget may restrict theextent that diversification is possible (on practicalgrounds), this is still clearly an area thatanalysts feel is worthy of more attention.

Investment governance

While some analysts felt that a robust investmentgovernance approach was a key attribute for aP&C insurer, some were wary of placingtoo much weight on any pronouncements madeby insurers on governance and investment capabilities. To back this up, some noted thatduring the last financial crisis certain institutionsheralded for having excellent enterprise riskmanagement systems suffered badly (and in somecases failed).

Clearly, there are approaches to investment that are valued by shareholders. The challenge for P&C insurers is to adapt them to their own situation.

.

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.