By Tim Jablonski, Consultant Actuary at EValue

This is all well and good, but what values of P and T ought to be used? How do the values of P and T vary from person to person, and from situation to situation, as they surely would? So, even defining the problem to solve is not an easy task.

However, let’s assume for now that we do know what values of P and T are applicable in a particular instance, and that we do know the details of the assets held. We can then look at how we might calculate, for example, the level of income that can be withdrawn from the assets, such that there is a 75% chance that the assets will not have run out within 30 years.

Now we have a more clearly-defined problem we can look to solve, how do we do this? There are a few obvious steps: 1) Find a good model of how the assets held will perform going forward; 2) Run the model with different levels of income withdrawn; 3) Solve the defined problem. Using the above three-step process: step 2 seems easy; step 3 looks a bit trickier, but can likely be solved relatively straightforwardly; but step 1 seems a bit more problematic… What is a ‘good model’? How might we ‘find’ one? How do we know when we have found one?

This leads us to the core issue of the entire exercise: is there a suitable model for projecting assets’ future returns – including all the various possible outcomes and the different probabilities of these outcomes – which can help us determine a ‘sustainable income’? If we can find this, then we are a few short, fairly simple mathematical steps away from arriving at our answer.

So what is a good model here? We all know that any model should be fit for the purpose for which it is used. This may seem like an obvious statement, which is easy to trot out glibly when required – such as here – but it is of real importance to understand the purpose for which a model is used in order to determine which requirements of the model have most significance for the model builder.

We have written at length on this previously, rather than go into detail on this yet again, it seems worthwhile to focus on one or two of the key considerations.

Because we are interested in the probability of achieving a particular outcome, it is clear that we need a stochastic model. However, not all stochastic models are equal: some are better suited for different purposes.

It has been said here before, and we will surely say it again, but it is so fundamental – and surprisingly not more widely realised - that it needs to continue to be stated: if you want to produce a stochastic forecast showing results over time (ie not just one fixed term forecast), you need to use an economic scenario generator (ESG) rather than a mean-variance-covariance (MVC) model.

The quality and suitability of an MVC model is highly dependent on the choice of time period over which historical performance is measured. This can be a somewhat arbitrary decision: choosing a period that is too long or too short, or choosing different periods across different asset classes, will lead to flawed and unrealistic results from the model. For example, too short a period may not give a true long term indication of expected returns; but choosing too long a period might include factors that are no longer relevant.

MVC models also take no account of how long an investment is held for, as they assume the same average return irrespective of the investment term. In reality, risk and return characteristics of assets vary by investment term. MVC models should therefore be used very cautiously for longer-term projections, and an awareness of their limitations is critical when using the output.

In contrast, an ESG can forecast outcomes for investments on a more realistic basis. ESG forecasts do not depend on historical performance. This keeps the forecasts firmly looking forward from the current economic situation. An ESG model builds a large number of possible, sensible and realistic economic scenarios by reproducing the fundamental real life characteristics of assets, producing reliable forecasts at multiple terms.

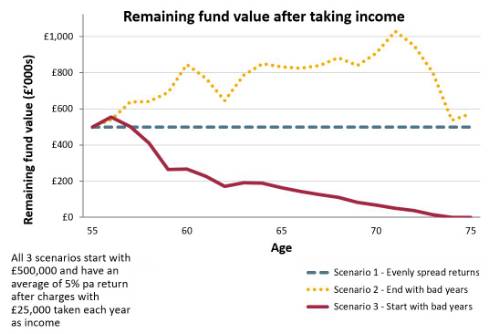

When drawing an income from an asset, the ‘path’ or ‘journey’ of returns has a significant effect on the outcome. For example, the graph below shows three scenarios all with the same average return but with the ‘bad years’ occurring at different times. See how the three paths differ significantly.

Given the effect that the specific investment journey has to the outcome of the calculation, it is clear that a good model should provide forecasts that are not only realistic overall, but also in each scenario which makes up the forecast.

Suggesting a potential outcome, which in reality is impossible, is not helpful. Each path or journey ought to be a plausible future economic scenario.

What more shall I say? For time fails me to tell of the importance of real world modelling, of strong empirical foundations, of normative modelling and controlled risk premia, of continued development and transparency, of a regular process of updating and calibrating, of credible yield curve modelling and back-testing, of internal consistency and dependence on current conditions. And all these considerations are of high significance when determining a suitable model.

Once we have a good asset model, we can define the problem we want to solve in terms of asset, timeframe and probability of not running out of money, and calculate the sustainable level of income that can be taken.

We must move onto the secondary question: how often should the sustainable income rate be revisited?

Here, an individual has started to withdraw an income from their assets in the hope that the money will last T years.

Clearly, there should be some ongoing monitoring to ensure that the level of income chosen remains an appropriate amount going forward. How frequently ought this to be monitored?

Leaving frequency aside for a moment, we might consider situations in which it would be appropriate to revisit the sustainable income rate. For example, if there were a significant market shock, this would have an impact on both the size of the assets and the expected future returns. It would be important to revisit the sustainable rate in this instance.

Also, if an individual’s circumstances changed in some way, e.g. health improvement or deterioration, such that the length of time that the income is required changes, then the sustainable income rate ought to be revisited.

Under smaller market changes, or indeed seemingly unchanging conditions, it is still important to revisit and review the sustainable income rate. There would be a new and known asset value, a new term, new expected returns (due to the regular process of updating and calibrating the model used). Even if things seem not to have changed much, enough would have changed for a review to be a useful exercise.

Under “normal” market conditions, how often ought that to be? We can’t say; but we can say that the sustainable income rate ought to be revisited regularly.

In summary, we find that we can calculate a sustainable income rate. To do so, we need to define what we want to calculate appropriately, eg a level of income that an individual can withdraw from their assets each year, such that they have a probability, P, of not running out of money within a particular period of time, T. We also need to find a good asset model for this purpose – this choice is crucial. One of the many key features of a suitable asset model is that it is an ESG rather than an MVC model, because we need to be able to model cashflow results over time in an appropriate way. Once the sustainable income rate has been determined, it should be reviewed regularly, and also when significant events occur.

|