By Fiona Tait, Technical Director, Intelligent Pensions

In fact, recent statistics from the Office for National Statistics (ONS) show that AE has delivered pretty much what it was designed to do at outset and the areas where it has failed to make an impact are those that were outside of the boundaries set in 2012.

Overall participation

The ONS figures show that overall participation rate in workplace pensions rose from less than 50% in 2012 to 78% in 2020. This is an incredible feat and well beyond what was predicted. Whether inertia is simply stronger than expected, or because people have cottoned on to the notion of receiving ‘free money’ from the government and their employer, opt-out rates have remained much lower than expected by even the most optimistic pundits. Clearly if the minimum contribution rate is raised, as it needs to be, then opt-opts may increase but we would still be well ahead of the game in 2012.

Non-eligible jobholders - age

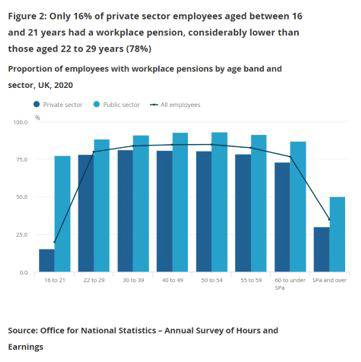

The fact that this improvement is down to AE is demonstrated by the fact that only 16% of private sector employees aged between 16 and 22 years, who are not eligible for AE, were members of a workplace pension in 2020. This compares with 78% in the 22 to 29 age group who are over the minimum age threshold.

The pattern is however different for public and private sector members. Looking at the same 16-22 age group, 75% of public sector employers are scheme members which is pretty much in line with older age groups. It is clear from this that if the age qualification was lowered to 16 the number of private sector savers would also increase.

Non-eligible jobholders - gender

Participation rates among full-time employees are nearly identical for men and women, with 88% of the former and 85% of the latter remaining in their schemes.

Among part time workers the rate is actually higher for women at 62% than men at 46%. However, this is overshadowed by other factors such as the fact that women are more likely to work part-time in the first place, 38% as opposed to 13% of male workers. They are, as a result, paid less and therefore contribute less to their workplace pension scheme, particularly once the lower earnings threshold is taken into account. Part-time workers are also less likely to exceed the earnings trigger of £10,000 and less likely to be eligible for AE in the first place.

Lastly, there is the not inconsiderable fact that these statistics only actually looks at employees. Anyone taking a career break, most of whom are likely to be women, will remain outside of the scope of AE during that time, as are self-employed workers.

Contribution rates

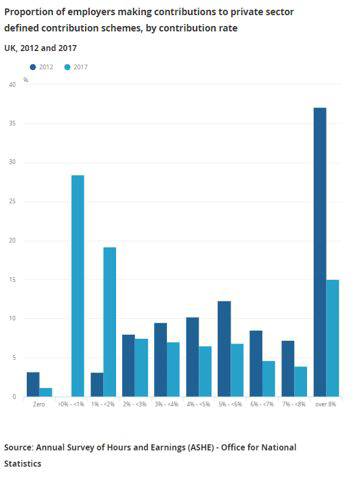

By far the most worrying statistic of all is however that, while more people are saving, the new savers are saving only minimal amounts. Previous figures from the ONS showed that the contribution rates for defined contribution pensions have clustered around the minimum contributions levels. If, understandably, both employers and employees are failing to voluntarily pay the levels required for an adequate retirement, then it is the minimum contribution rate which will have to increase.

Summary

All of this shows that AE has been a success within its original parameters, but that the parameters themselves must be changed if we are to achieve adequate retirement for as many people as possible.

The DWP is aware of the issues, as was shown in their review of AE in 2017. This report suggested a number of key changes including:

• Lowering the eligible age limit from 22 to 18

• Removing the lower earnings limit so that contributions are made from £1, and

• Gathering evidence to look again at contribution levels

It seems to me that it is time to move forward with this. Granted, there a lot of other things on the legislative agenda, but the problem of retirement adequacy will only get worse the longer it is left. Pensions should not be seen as a rainy-day fund for the Treasury or short-term vote winner (or, more likely, loser); they need to be an integral part of government policy.

Sources:

ONS: Employee workplace pensions in the UK - Office for National Statistics (May 2020)

ONS: Pension participation at record high but contributions cluster at minimum levels - Office for National Statistics (May 2017)

|