Andrew Tully, Technical Director at Canada Life, commented: “People continue to be attracted to stripping cash out of their pensions. This is often before planned retirement ages, and will inevitably in many instances be triggering large tax bills. On the one hand it shows the pension freedoms are working, but it also shows an emerging picture of large amounts leaving the pension system potentially leaving very little for people to live on by way of a regular income. People are not sticking to the rules as there are no rules.

“Stripping cash from a pension can trigger unintended consequences including limiting the amount you can subsequently save into a pension. This can be very restrictive for those people who have plans to continue working and they and their employer continue to pay in.

“Our research suggests only a third of people seek financial advice before accessing their pension, so many will be blissfully unaware of the pitfalls or indeed the amount of tax likely to be paid.

“Without the right financial advice, most people will not strike the right balance and achieve the best outcome in retirement.”

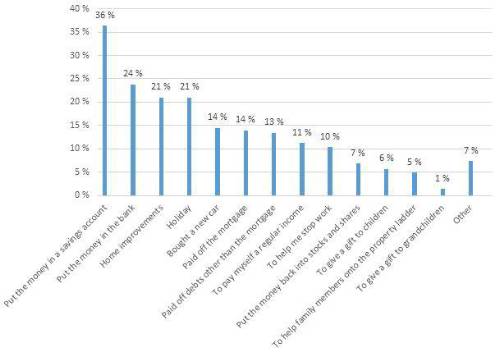

Source: Canada Life 20.3.19 (note respondents could tick all that apply)

Top tips:

1. You don’t have to take your whole pension in one go. You can spread withdrawals over a number of tax years, which will hopefully make the most of your personal allowance.

2. Think about what you are going to do with the money. There is no benefit in withdrawing cash from a pension (and paying tax on that withdrawal) to simply put the money in a bank account.

3. Once you’ve flexibly accessed your pension, HMRC restricts the amount you can continue to save into your pension. This is called the Money Purchase Annual Allowance and is currently set at £4,000. This can cause problems if you plan to keep on working and both you and your employer are paying into your pension.

4. Pensions are very tax efficient, and can have significant benefits for your estate from an inheritance perspective, so think about using other investments before you access your pension, for example an ISA.

5. If you make a withdrawal, your pension provider is likely to apply an emergency tax code, which may well mean you pay more tax on the withdrawal than you expect. You can reclaim the tax directly from HMRC using one of three forms, P55, P53Z or P50Z. There is no need to wait until the end of a tax year to do so.

6. It helps if you know the level of tax you are likely to pay, free calculators are available including here https://www.canadalife.co.uk/tools/pension-tax-calculator

HMRC have released its latest figures on the number and value of flexible payments from pensions

|