Steven Cameron, Pensions Director at Aegon, said: “The latest inflation figures for the year till April, dropping from 10.1% to 8.7%, may boost the chances of the Government delivering on its commitment to halve inflation to 5.1% by the year end. This would also offer some relief to millions of struggling households, although prices are continuing to rise.

“However, it’s a double-edged sword for state pensioners waiting to see what the triple lock formula may grant them as an increase next April. The triple lock pays out the highest of price inflation to September, earnings growth taken at a point two months earlier (the year-on-year increase for the three months May to July) or a minimum rate of 2.5%. Many have speculated that with high and volatile inflation and earnings growth, this may not be sustainable longer term.

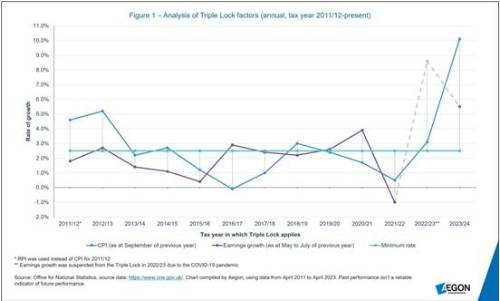

“Since being introduced during the 2011/12 tax year, the triple lock has been based on price inflation six times, earnings growth three times and the 2.5% minimum rate has kicked in four times. For the April 2022 increase, because of earnings distortions as a result of the pandemic, the earnings growth component was dropped from the formula and the increase was based on inflation of 3.1%. (See Figure 1)

Figure 1 – Analysis of Triple Lock factors (annual, tax year 2011/12-present)

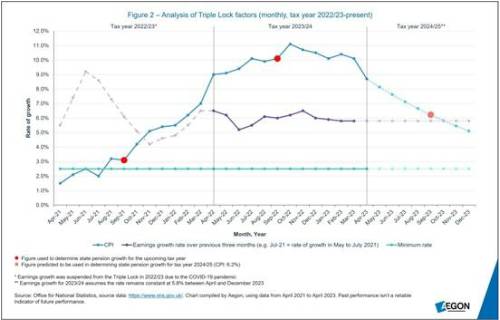

“State pensioners now need to wait to see the trend in inflation figures over the coming five months, as well as what might happen to earnings growth. If inflation falls steadily to 5.1% by the year end, in line with the Government’s commitment to half inflation, then the September figure might be 6.2%. If earnings inflation remains at current levels, the earnings component would be slightly less at 5.8%. This would produce an increase in April 2024 of 6.2%, far below this year’s earlier double-digit increase of 10.1% but still coming at a high cost to Government. (See Figure 2)

Figure 2 – Analysis of Triple Lock factors (monthly, tax year 2022/23-present)

“The Bank of England remains committed to getting inflation down to its target of 2% at some point in the future. However, there remains much uncertainty over when that might be achieved, with Andrew Bailey, the Governor of the Bank of England, revealing that the model it has been using to predict inflation may not be as reliable as it was in the past. This leaves the prospect of the triple lock granting unpredictable and potentially costly increases in future years. The big question is whether any political party will dare to reveal its longer term plans for the triple lock ahead of the Election.”

|