The last quarter was a record for the number of payments (648,000) and number of people who have used the freedoms to flexibly access their pensions (284,000 individuals), although the total value of payments in the last quarter (£2.06bn) is just shy of the highest value recorded in Q2 2018 (£2.27bn).

Commenting on the statistics, Andrew Tully, Technical Director, Canada Life, said: “Pensions continue to be treated as cash machines with the latest data showing a record amount withdrawn in the last tax year, up over £1.5bn from the 17/18 tax year. While this behaviour may not be cause for concern just yet, our research suggests only a third of people seek advice before flexibly accessing their pension. This can leave consumers exposed to a new set of risks including paying too much tax than necessary on withdrawals, or leaving the money languishing in low or near zero paying deposit accounts.

“Pension freedoms transferred all of the risks around retirement onto the consumer and with that comes much greater responsibility. The risk of running out of money is very real, as there are no mechanisms to prevent people depleting their pots too quickly. Conversely, there is also the risk that people don’t spend enough in retirement for fear of running out of money. Without the right financial advice, most consumers will not achieve the best outcome in retirement.”

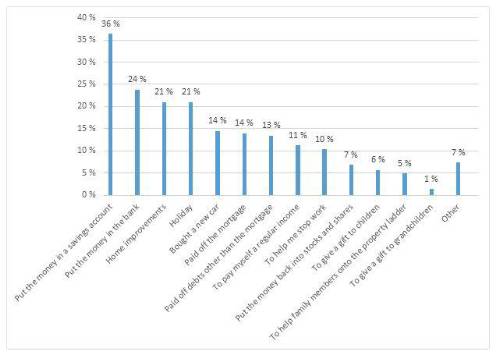

What have people used their cash lump sums for?

Source: Canada Life 20.3.19 (note respondents could tick all that apply)

HMRC Latest Figures

Top tips:

1. You don’t have to take your whole pension in one go. You can spread withdrawals over a number of tax years, which will hopefully make the most of your personal allowance.

2. Think about what you are going to do with the money. There is no benefit in withdrawing cash from a pension (and paying tax on that withdrawal) to simply put the money in a bank account.

3. Once you’ve flexibly accessed your pension, HMRC restricts the amount you can continue to save into your pension. This is called the Money Purchase Annual Allowance and is currently set at £4,000. This can cause problems if you plan to keep on working and both you and your employer are paying into your pension.

4. Pensions are very tax efficient, and can have significant benefits for your estate from an inheritance perspective, so think about using other investments before you access your pension, for example an ISA.

5. If you make a withdrawal, your pension provider is likely to apply an emergency tax code, which may well mean you pay more tax on the withdrawal than you expect. You can reclaim the tax directly from HMRC using one of three forms, P55, P53Z or P50Z. There is no need to wait until the end of a tax year to do so.

6. It helps if you know the level of tax you are likely to pay, free calculators are available including here https://www.canadalife.co.uk/tools/pension-tax-calculator

|