“Many expected today’s news that the UK entered recession last year due to the impact of high inflation and rising interest rates on households and retailers, but the ‘r’ word always causes concern. While this one will hopefully be short and shallow, even a mild recession tends to have some impact on your personal finances, and it’s worth thinking about what it might mean for your savings.

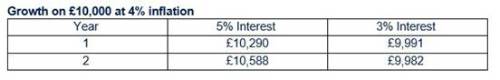

“The most immediate impact on your short-term savings is likely to be retail banks pricing in an expected cut to the base interest rate, as the fact we’re officially in recession will heap pressure on the Bank of England to start to change their position. We’ve already started to see interest rates on best buy savings accounts fall from around 6% last year to below 5%, and now’s a good time to shop around for the best rate before rates possibly fall further. Our analysis found that, based on the current inflation level of 4%, a £10,000 savings pot would be equivalent to £10,588 after two years with an interest rate of 5%. If rates fell and you secured a lower interest rate of 3%, it would be worth £9,982 in real terms after the two years.”

|