Kate Smith, Head of Pension at Aegon, comments:

“Uber drivers will shortly start to be auto-enrolled into a workplace pension for the first time and benefit from a valuable employer contribution. Workers who meet the age and earnings criteria will benefit from a total pension contribution of 8% based on a band of earnings, with 3% paid by their employer, and 5% paid by the worker, including pension tax relief. While the employer contribution could be considered as a 3% pay rise, it’s important that Uber workers understand they will only keep the right to this if they pay a 5% contribution and don’t opt-out of their new workplace pension. Take-home pay might dip slightly due to paying personal pension contributions, but over the longer term benefiting from the 8% pension contribution will enable Uber drivers to build up a valuable retirement income.

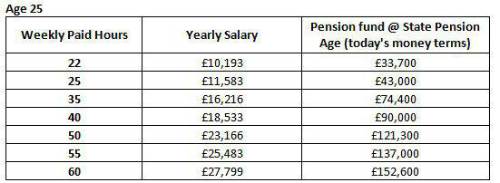

“The change means an Uber worker in their mid-20s paid for 22 hours a week – the minimum needed to meet the £10,000 auto-enrolment threshold on the new national living wage from April – could have a pension fund worth £33,700 at state pension age in today’s money terms. The initial personal monthly contribution to achieve this is just £13 from take home pay.

“However, many Uber drivers work much longer hours than this and the more hours they are paid for, the higher their pension fund will be at retirement age. A worker in their mid-20s paid for 60 hours a week could have a pension fund worth £152,600 in today’s money terms.”

Aegon analysis, March 2021. Based on earning the National Living Wage from April 2021. Numbers rounded to nearest ‘000.*

|