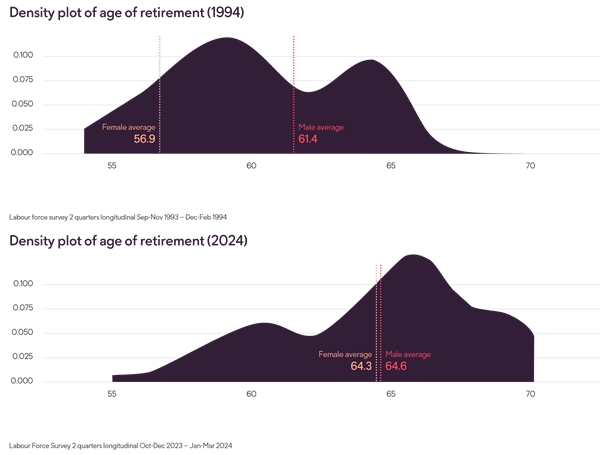

New analysis by Phoenix Insights, Phoenix Group’s longevity think tank, finds the average age of retirement for women in the UK has increased by seven years in the last thirty years, with both men and women now retiring on average age 64.

The analysis is part of Phoenix Insights’ latest report which explores how people save, work, and retire, including insight on changes to the average age of retirement. Thirty years ago, there were two distinct peaks in when people chose to retire, driven almost entirely by gender differences; women retired on average age 56 (and 10 months) and men at 61 (and four months). Fast-forward to 2024 and the gender differences have largely disappeared with both men and women retiring on average at 64 – a seven-year increase for women and three-year increase for men.

Source: Phoenix Insights Labour Force Survey secondary analysis (2024)

People are starting and stopping work later in life, remaining in education for longer than previous generations and delaying retirement. In 1994 around one in four (27%) 18-year-olds were students, whereas today (2024) this is nearly half (48%). At the other end of people’s careers, in 1994 around three in four (73%) 65-year-olds were retired, compared to just over one in three (39%) in 2024.

Patrick Thomson, head of research analysis and policy at Phoenix Insights, Phoenix Group’s longevity think tank said: “There have been dramatic shifts in how we retire in recent decades. Thirty years ago, women typically retired in their mid-50s and men in their early 60s. Today, those gender differences have all but disappeared, with both men and women retiring on average at 64. State pension age increases has been the primary driver behind this, but it’s not just about changes to pension policy. Women now make up a much bigger part of the workforce and greater workplace flexibility means more people now transition to retirement gradually, staying in work for longer on reduced hours. There has also been a trend towards self-employment among the over-50s. This can give people more choice and control over their working life, but may also be due to being unable to find work with an employer.”

Key drivers for later retirements

The state pension as a signal

The state pension age acts as a signal for many to enter retirement, especially for those struggling to work for longer, or without private pension savings. This means changes to the qualifying age has been a significant factor for increasing retirement ages over the last decade. Between 2010 and 2018 the state pension age increased for women from 60 to 65, becoming the same as men, and increased again between 2018 and 2020 to 66 for both men and women. We will see further rises to 67 in the next few years.

However, Phoenix Insights polling suggests the state pension signal may not be as influential for future retirees who think they will want to or need to remain in work. Nearly half (45%) of non-retirees say they expect to remain in work beyond their state pension age. And this is especially true for those currently out of work who expect to retire on average at 71, compared to 66 for those in work[.

Rise in self-employment

There is now a sizable trend for people to enter or transition into self-employment after the age of 50. One in five workers aged 60-64 are currently self-employed, increasing to one in three for workers over-65[iii]. Self-employment can offer flexibility and control for people working for themselves, and for those unable to find work with an employer later in life it can be a way of extending their working life.

But it is important the self-employed continue to save for retirement where they can as this group are currently among the most under-pensioned group. Analysis shows nearly two thirds (64%) of self-employed workers aged 60-65 have zero private pension saving[iv].

Flexible work

In recent years, flexible working arrangements – both formal and informal – have surged in popularity, becoming a key factor in why people choose to stay in the workforce longer. Phoenix Insights polling reveals that flexible work is the top reason for continued employment later in life[v]. One-third of over 50s now work part-time, and the rate of home-working in this age group has more than doubled post-pandemic, jumping from 10% to 22.4% between 2020 and 2023[vi]. Embracing flexible work patterns is essential for supporting over-50s to remain active and engaged in their careers.

Patrick Thomson continues: “Flexible work has been a game-changer for supporting over-50s to continue to work, earn and save later in life, but we still have high rates of economic inactivity among this group. Many over-50s fall out of work early due to reasons such as caring responsibilities or ill health and find it difficult to re-enter the workforce. Being out of work prior to state pension age is a major driver of poverty, so it’s crucial we reverse this trend in the interest of individuals, businesses, and the wider economy.”

|