Despite the government’s claim in its Build Back Better plan that “as a result of this new cap, people will no longer face unpredictable or unlimited care costs,” its current proposals mean that many care home residents would still need to find potentially hundreds of pounds a week extra to pay ‘daily living costs’ and other extras they may want.

The research by Just Group found nearly three in five (58%) adults said it was unfair to expect care home residents to pay what could be five or six figure numbers for extended periods in a care home even after their total spending had surpassed the cap.

“Many people have been left with the impression that the £86,000 cap would be the total amount they would be expected to spend on their own care before starting to receive taxpayer support,” said Stephen Lowe, group communications director at Just Group.

“In fact, only that spending specifically on ‘personal care’ – the professional support with activities such as washing and dressing – is likely to count towards the cap.

“Around £200 of daily living costs covering accommodation, food and utilities will not count as spending on personal care and will remain the individual’s own responsibility to pay if they can afford to. Our research shows people think these costs would be included in the cap.”

The research found that only 15% of adults were able to identify that they would still have to fund some elements of their care costs even after reaching the cap.

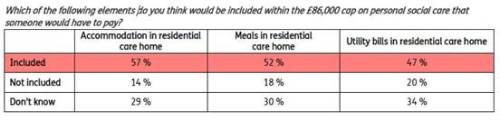

When asked specifically whether certain daily living costs would be included in the £86,000 social care cap, more than half thought accommodation (57%) and meals (52%) would be covered in a residential care home. 47% thought utility bills would be too and a high level of confusion was evident with at least 29% saying they were unsure for each element.

Spending towards ‘personal care’ will not be the cash amounts people pay for the care they are personally receiving but will instead be based on an assessment by the local authority of the cost of meeting their need, which may be lower.

This would mean that if the local authority assesses two people as having the same care need, those spending extra for a higher standard of care home will not reach the cap any quicker than those spending a basic amount.

“Despite the care reform proposals being published and publicised, the majority of people still don’t understand what help the State will give and how much of their own money is likely to be needed,” said Stephen Lowe.

“Given changing demographics, it is likely that more and more people will require residential care at some point in their life and we cannot have a system where millions of people are still in the dark over what they could have to pay.

“A very significant public awareness campaign is essential over the next few years to ensure the public become aware of their responsibility and are not kept in the dark.”

|