By Martin Hooper, FIA, Associate at Barnett Waddingham

Sponsors of defined benefit pension schemes should be prepared for tougher negotiations for funding valuations being carried out during the course of 2018 – particularly for those companies where dividend payments to shareholders have increased significantly in recent years.

Funding deficits down but behind target

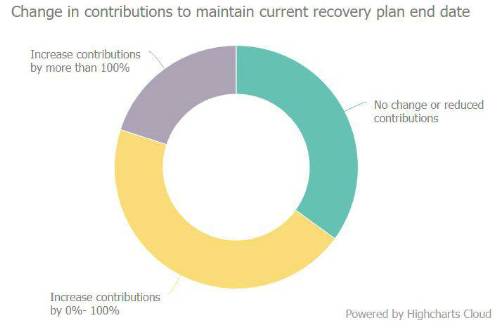

For schemes carrying our valuations in “tranche 13” (i.e. between September 2017 and September 2018) TPR is expecting funding positions to have improved since the previous valuation, but not by as much as would have been expected given current recovery plans. TPR’s expectation is therefore that current recovery plans will not be sufficient to pay of deficits, – with 20% of companies facing an increase of more than 100% in contribution levels unless an extension to recovery periods is agreed with the trustees.

Affordability is up – but picture is mixed

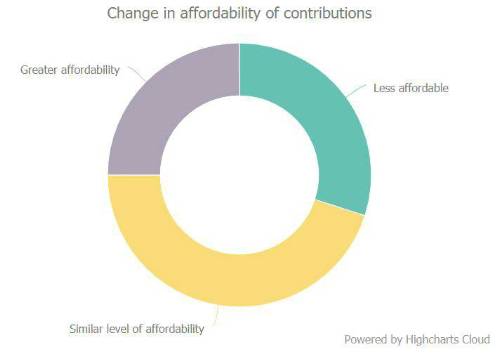

According to TPR’s analysis it is expected contributions with have become more affordable since the previous valuation.

Those companies where the affordability has increased will certainly be under pressure to increase contributions if the current recovery is no longer expected to pay off the deficit. Companies where affordability has reduced may come under pressure to provide alternative support for the pension scheme (for example through contingent assets) as Trustees are likely to be more focussed on developing contingency plans this time round.

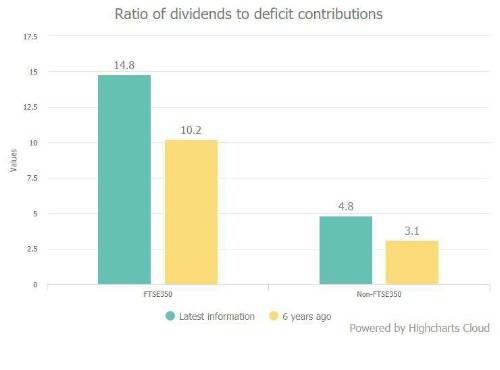

Increased focus on dividend payments

TPR is also keen to ensure pension schemes are being treated relative to other stakeholder – particularly in term of whether dividends are being prioritised at the expense of higher deficit contributions. TPR’s analysis shows that the ratio of dividends to deficit contributions paid by FTSE350 companies has increased significantly over the past six years. Non-FTS350 listed companies have also seen an increased in this ratio although this has not been as marked.

What does this mean for sponsors?

Sponsors will be facing funding negotiations where the Trustees will be pushing hard for higher contributions. By being pro-active the sponsor can use this as an opportunity to take control of the long term strategy of dealing with the pension scheme. Areas to focus on are:

Own the long term strategy – What is the the objective for the scheme? Over what timeframe does the sponsor want to settle liabilities and what are the options for settlement?

Is the investment strategy delivering? - Review whether the investment strategy is appropriate. Is the level of risk appropriate for the level of return? Understand how risk can be reduced without compromising the expected returns required to achieve the long term objective.

Non cash funding could be the solution – Understand the funding solutions that can be used as opposed to paying additional cash – for example, escrow accounts, or asset backed funding vehicles. These can increase security for Trustees and reduce short term cash calls.

Take the message to the Trustees – Be on the front foot when discussing the employer covenant and dividend policy with the Trustees.

Overall the trustees of your pension scheme may feel now the time is to ask for more. You need to ensure this is also right for the business.

|