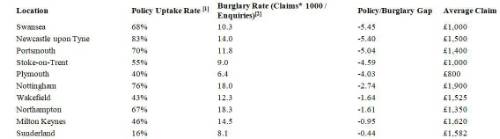

Based on the rate of millennials taking out policies against the local burglary rate, the study found that Swansea comes out top, followed by Newcastle upon Tyne and Portsmouth. The least prepared city covered in the research is Bradford, which also has the third-highest burglary rate across major cities in England and Wales, while the location with the highest average claim is Colchester at £2,005.

The table below shows the burglary rate and the uptake rate of contents insurance policies in each area. In locations where there is a higher policy/burglary gap (i.e. a lower number of policies compared with thefts), millennials are more at risk than those who live in areas with a lower gap (i.e. a high number of policies compared with thefts).

Technology protection is a popular reason for taking out insurance, with 24.8% insuring their laptops and notebook devices against theft. That's higher than any other item and a smart choice as they are stolen in 31% of burglaries. As well as protecting their technology, millennials rely on it to protect their homes too; from smart doorbells and sensors to CCTV, 25-34 year olds use these security measures more than any other age group [3].

Here are some tips to ensure you’re taking the correct precautions when it comes to protecting your home and getting the best deal possible on your cover:

1. Consider basic cover – Depending on what you need to insure, if you want to keep costs down, you may wish to consider “basic cover”, which is a cheaper option but still worthwhile. Read through potential policies carefully to make sure they cover exactly what you need and if you’re ever unsure, contact the provider.

2. Look at security options – Adding an extra layer of protection to your home is always worthwhile - better locks, burglar alarms and joining the local Neighbourhood Watch scheme can all help reduce your premium.

3. Pay annually – Paying monthly may be more flexible, but paying your insurance on a yearly basis can reduce the overall cost.

Rachel Wait, consumer affairs spokesperson at MoneySuperMarket, commented: “We all try to protect our homes the best we can, but unfortunately burglaries do happen and they can be a very stressful experience.

“While there’s no way to guarantee your belongings are protected, contents insurance can at least provide some peace of mind that you won’t suffer financially in the event of a break-in.

“It’s good to see that young people in Swansea are aware of how important insurance can be. But those in cities like Colchester, where the value of an average claim is high, and Bradford, where there are comparatively few policies, should consider reviewing the insurance options available to them.

“It’s important to shop around when taking out or renewing your contents insurance, to find the cover that best suits your needs.

Check a variety of different insurers and make yourself a new customer every year to see what new savings are available - for example, by comparing through MoneySuperMarket you could save up to 43% on your home insurance.”

For more information on where millennials are best at protecting their belongings, and how they measure up against other age groups, review the full study on MoneySuperMarket.

|