Roll the clock forward two years, that same annuity would pay around £7,000 a year, an increase of 54%, driven by rising interest rates and the returns available on gilts. Over the course of a 20-year retirement, the annuity at today’s rates would deliver around £49,200 extra income compared to an annuity sold in January 2022.

Annuity providers have announced strong sales, and Canada Life recently reported record individual annuity sales of £1.2bn for last year.

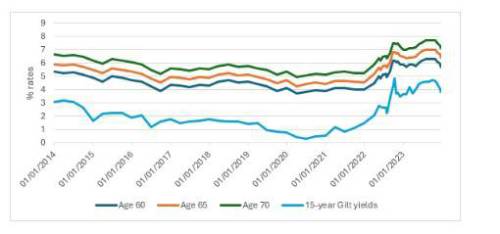

But where is the annuity market, and incomes, heading? Annuity rates are driven by the returns available on gilts, which in turn are linked to the Bank of England base rate. The Bank of England has held steady for the past seven months with a base rate of 5.25%, and financial markets are predicting a cautious approach to any changes in the near term.

Nick Flynn, retirement income director at Canada Life explores where the market may develop: “The annuity market is incredibly busy, as clients seek to capitalise on the relatively high incomes currently on offer. Given where we’ve been in the recent past, this is clearly a positive story for the many customers seeking retirement income security. While I don’t have access to a crystal ball to predict the future, annuity rates are closely linked to the returns available on government bonds. As the Bank of England sets the base rate, this in turn changes the yields on these bonds, or gilts, as they are known. As a general rule, a 30-basis point rise in yields on gilts would increase annuities by 3%.

“While we continue to see inflation higher than the 2% target rate set by the Government, the Bank of England will tread very carefully before considering reducing the base rate. In fact, at the last MPC meeting, two of the members voted to increase base rate. So, on that basis, annuity rates are likely to remain at or near recent historical highs. However, wider market forces can change rates, for example, competition from providers who offer annuities in the open market seeking market share.

“While it may be a fool’s paradise to predict annuity incomes in the future, what I know today is customers looking for income security, either at the point of retirement, or at the point of de-risking their drawdown strategy, can now get much better value from their choice of an annuity.

“Always seek the advice of an annuity specialist or regulated financial adviser before taking any decisions. These professionals will help guide you through the myriad of options available, whether that be 100% value protection, longer guaranteed periods, or simply taking your health and lifestyle into account, which may result in a better income.”

How lifetime annuity rates have changed over time

Source: Canada Life annuity rates over time, as at 21/12/2023

|