The most likely change – a cut to the annual limits on allowable pension contributions – could leave more than 100,000 higher earners out of pocket by up to £4,000 each.

The paper highlights three factors which make a cut in pension tax relief highly likely:

- The Chancellor faces big spending pressures, particularly to meet the £20 billion per year needed for the NHS, but also because of the need to improve public sector pay, to deal with concerns over Universal Credit and to meet rising social care costs;

- Political commitments mean that raising other taxes such as income tax, VAT, petrol duties or corporation tax rates would be very difficult;

- Pension tax relief costs the government around £25 billion per year [net of the tax paid by today’s pensioners], and that cost has risen sharply in recent years;

Since 2010 there have been six separate cuts to pension tax relief – three to the Lifetime limit on pension pots which can be accrued with the benefit of tax relief, and three to the annual amount which can be contributed. There is every reason to think that something similar will happen in the Budget.

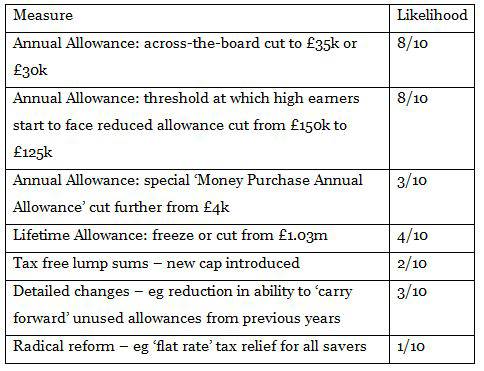

The paper lists potential changes to tax relief and assigns a likelihood to each. The following table summarises the key options which the Chancellor will be considering together with our assessment of the likelihood of each happening:

The paper also concludes that radical reform is unlikely in this Budget. Radical reform would take years to implement, including needing HMRC to devote scarce IT resources to re-writing its own systems, and would create large numbers of gainers and losers which would be politically challenging.

Commenting on the analysis, Steve Webb, Director of Policy at Royal London said: “Time and again, pension tax relief has been the go-to source of money for cash-strapped Chancellors. Pensions should be a long-term business where people can plan with confidence for their retirement, knowing that the tax rules around pension saving will be stable. But the Chancellor will find it hard to raise other, more visible, forms of taxation and is likely to revert to the ‘salami-slicing’ of pension tax relief. We fear that the amount people can contribute into their pensions each year will be cut yet again, sending out entirely the wrong message at a time when we need people to be saving more, not less”.

|