Over a third (37%) of pet owners admit they have lied to their boss about taking time off to nurse a poorly pet, giving a made-up explanation instead.

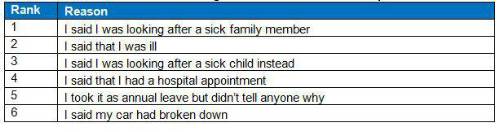

Top of the list of fake excuses given to bosses was looking after a sick family member or child (20%), meanwhile one in 10 (11%) pet owners said they told their boss that they were sick rather than their pet.

Most common fake excuses for taking time off to look after a sick pet

Men (42%) are more likely to lie about taking time off to comfort a sick pet and lie about the reason than women (32%), and younger generations are also more likely to fib about their pets, with 65% admitting to lying to their employer about it.

Meanwhile, two fifths of pet owners (43%) have taken annual leave to look after their pet when it’s been ill, while a quarter (25%) said they would take leave if their pet fell ill.

Farewell Fido

While almost half (47%) of pet owners have taken time off work after a pet passed away, the majority (71%) lied about why they weren’t in work. A fifth (20%) claimed they didn’t tell the truth because they were embarrassed and almost a third (30%) said it was because their boss wouldn’t be happy or wouldn’t understand.

Pet-ernity leave

Nearly two thirds (60%) of pet owners or another member of their family took time off work when they first brought their pet home, with over a third (39%) taking off three or more days to settle their pet.

For half of pet owners in the UK, welcoming a new pet into the home properly is a big priority and think employers should offer “pet-ernity leave” for employees to help their latest addition to their family settle in.

Younger generations are the biggest advocates of employers introducing a “pet-ernity” policy (79%).

Meanwhile, older generations are more likely to take more time off to settle their pet with over a third (34%) of over 45s taking a week off compared to just 9% of 18-44 year olds taking the same length of time.

Peaky pups

Previous research from Admiral has revealed that a quarter (24%) of dog owners say they weren’t prepared for the cost of owning a dog and that it was more expensive than they expected.

Perhaps unsurprising when you consider that 43% of dog owners admit to doing no research on costs before getting their pup.

Rank Top 10 dog breeds for cost of treatment

Topping the list as the most problematic pooch is the cocker spaniel, with both the highest number of pet insurance claims and highest average costs for treatment, with an average lifetime claim cost of £3,112.

Cocker spaniels are followed by medium and small-sized crossbreeds as the most problematic pooches .

Despite this, larger breeds like the Leonberger and Bernese Mountain dog see higher monthly premiums.

Sian Humphreys, Head of Pet Insurance at Admiral says, “Although not true for all dogs, larger breeds generally have a shorter lifespan and if they are going to develop medical conditions, it’s likely to be sooner in their life. They also have a higher potential to do more damage, impacting third-party liability insurance in the policy.”

Moggie Malady

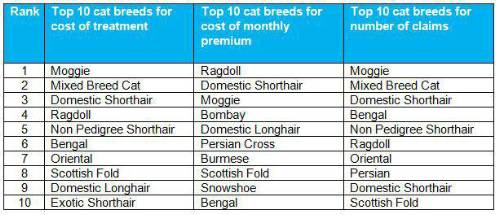

When it comes cats, moggies take the top spot for number of claims and the cost of claims, and they’re also the third most expensive cat breed to insure in the UK.

Sian Humphreys, Head of Pet Insurance at Admiral says, “Medically, Ragdolls are prone to congenital heart problems and can have a heart murmur from birth. This will either disappear as the cat gets older, or it can develop into something more serious.They’re also an expensive breed of cat, increasing their risk of being stolen. “

Rank Top 10 cat breeds for cost of treatment

Sian added: “Owning a pet can be really rewarding and for most animal lovers, pets play an important part in your life.”

“However, it’s also a big commitment and one that comes with responsibilities so it’s important to do your research beforehand and are prepared for every eventuality.

“There are some costs you can plan and budget for, but things like vet bills can soon add up if you’re not prepared and don’t have the right insurance in place.”

|