A new report commissioned by Aviva, the UK’s largest insurer, concludes that fundamental reform is needed to reduce the number and cost of whiplash claims which will, in turn, cut the cost of motor insurance for the long term.

The UK is on track to submit more than 840,000 motor injury claims*** to the Claims Portal for the year ending April 2015, or 2,300 claims every day. This is up 9% on the previous year - or 200 extra claims per day.

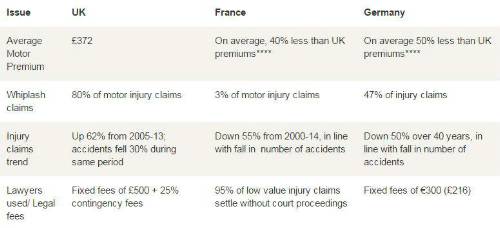

Aviva analysed the motor injury claims it received in 2014 and found that 80% included whiplash, a significantly higher figure than seen in many other European countries. One of the reasons for the high number of whiplash claims is the huge financial incentives for the third parties who submit the claims. Aviva’s data shows that 96% of personal injury claims it received last year were brought by third parties such as claims management companies (CMCs), personal injury lawyers and alternative business structures (ABS).

Maurice Tulloch, CEO, UK and Ireland General Insurance, Aviva said:

“Last summer Aviva said that motor premiums will have ‘nowhere to go but up’ if we failed to address the excessive numbers of minor motor injury claims and the escalating costs surrounding them. We are here to help our customers when they need it, and pay genuine claims quickly. But we must address how to best treat the excessive number of fraudulent, exaggerated and minor whiplash claims which are driving up the cost of insurance.

“Sadly, we are now witnessing a resurgence in the number and cost of whiplash and soft-tissue injury claims despite some very positive developments, such as the LASPO Act, which helped reduce customer premiums. The introduction of a new system for sourcing medical reports in soft tissue injury claims (known as MedCo) is also a step forward.”

Out of step with Europe

Aviva commissioned Frontier Economics to understand what the UK could learn from countries that have successfully reduced the number and cost of whiplash claims between 2005 and 2013. Their analysis established that UK motor premium rates rose faster than other European countries over the last decade, including Germany, France, Sweden, Norway and Spain.

Aviva’s Roadmap to Fighting Whiplash

Aviva has developed six recommendations for reducing the number and cost of whiplash claims. Introducing these in the UK could achieve the desired outcome of fewer whiplash claims, lower premiums, helping those with genuine injuries get the care they deserve and tackling those who seek to abuse the system by profiting from fraudulent, exaggerated, or minor, short-term injuries. Key features include:

-

Reduced Limitation Period: All whiplash/ soft tissue injury claims should be made within 12 months of the accident as opposed to the usual three year limitation period.

-

Time Limits and a Threshold: The claimant’s symptoms should last longer than 3 months. This should be evidenced by medical records.

-

Rehabilitation – care, not cash: Insurers should provide treatment of up to three months to their policyholders or the injured party regardless of who is at fault for the accident.

-

Medical Evidence - Where the symptoms persist beyond three months, an independent medical report should be obtained from the new Government vehicle MedCo between three and 12 months after the accident for whiplash/soft tissue injury claims.

-

Level of Disability – Medical reports should assess the level of disability, and compensation would be recoverable if there is actual evidence of injury.

-

Predictable damages – Where a claimant is able to demonstrate he or she has overcome the threshold, damages for pain, suffering and loss of amenity should be awarded against a clear, transparent tariff.

Aviva’s package of reforms demonstrates how a ‘care, not cash’ system of treating minor, short-term whiplash-type injuries could operate. Aviva first outlined its suggestion of treating minor whiplash with rehabilitation in July last year, which, in conjunction with other reforms such as banning all referral fees and raising the Small Claims Track Limit, could save £50 on the cost of motor insurance. Both referral fees and the excessive legal fees are adding to the cost of motor insurance, but failing to deliver any tangible value for the customer.

Maurice Tulloch continued:

“The UK’s compensation culture is at the root cause of the £93 cost of whiplash claims paid by motorists within their insurance premiums. Our customers have told us they are fed up with compensation culture and all its trimmings: the nuisance texts and calls from claims management companies, excessive lawyers’ fees and fraudsters abusing the system for their own financial gain. It doesn’t have to be like this.

“Aviva’s plan shows that it is possible to cut the cost of motor insurance and ensure those who have suffered genuine injuries get the care or compensation they deserve.

“We believe that everyone is entitled to fairly priced insurance to protect what is important to them. Introducing these reforms is a challenge but we will not hide away from this - the UK’s motorists deserve even more affordable motor insurance.”

To view the full report please click on the link below

|