White collar workers should not bet on being average or they risk running out of money before their days do and running into diabolical circumstances in retirement according to new research from Mercer.

Mercer has analysed the mortality rates of public sector pensioners and revealed (allowing for continued improvements in mortality) that:

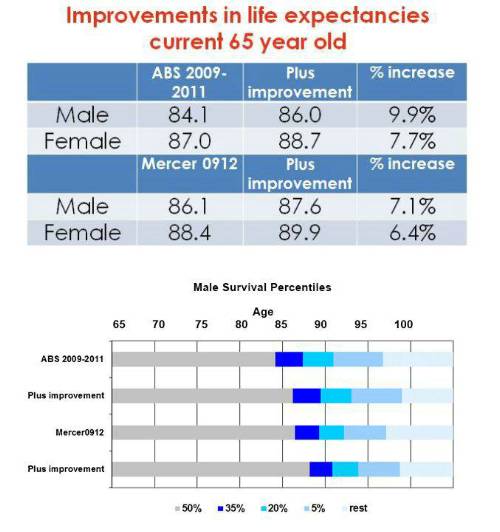

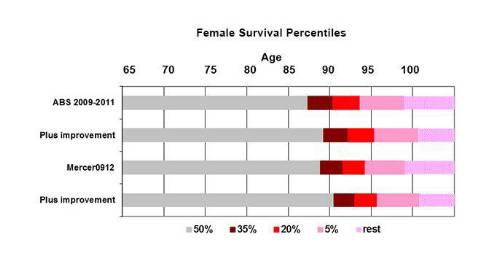

- 50% of retiring white collar male workers are likely to live to 88 years; 35% are likely to live to 91; 20% are expected to live to 94; and 5% will live to 99 years – well above the average life expectancy of 84.1 for men.

- 50% of female white collar workers are likely to live to 91 years; 35% are likely to live until 93; 20% are likely to live to 96; and another 5% will live beyond 100 – well above the average life expectancy 87 for females.

Mercer’s research is the most comprehensive research of life expectancies for superannuation scheme members in Australia. It highlights the serious risk of planning finances, career, retirement, and health, including aged care services, based on the expectation of average life expectancies.

Mercer’s Managing Director and Pacific Market Leader, David Anderson, believes the implications of the research are far reaching and should hit home for individuals, businesses and policy makers in relation to superannuation savings, investment portfolio construction, healthcare and health system load, aged care and the need for personal financial advice.

“We know half of all public sector workers – which can fairly be extrapolated to apply to Australia’s nearly 8 million white collar workers - will live well beyond the average and we need to begin planning more accurately for financial security at a personal and macro level,” he said.

Mr Richard Boyfield, Partner at Mercer and Leader of Mercer’s Public Sector retirement services, said “Average life expectancies are irrelevant when saving and planning for retirement. In fact, it is risky for policy makers, superannuation funds and individuals to use average life expectancy for retirement planning.”

“The findings have significant relevance for Federal and State Governments, in terms of the impact on public sector pension liability, but also have repercussions for superannuation funds, employers of white collar workers, private health insurers, aged care operators and individuals,” Mr Boyfield said.

“Living well beyond the average changes the goal posts for retirement planning – it obviously means you need to save more, maybe work for longer, and think more about healthcare and aged care. There are ramifications for super funds, employers, financial advisors and health care providers and insurers.

“For example, an increase in life expectancy is likely to increase the demand on public health services. Private health insurance could become a more important consideration for people and should be factored into financial plans given the rising cost of health premiums.

“Aged care services are a real possibility if living beyond 90. The cost to care for someone in a residential service can be as high as $236 per day (around $86,000 per year). Government subsidies for this may depend on your family arrangements and health requirements and finances should be carefully planned so you have more choice and greater control.

“White collar workers need to think beyond averages and super funds need to ramp up innovation in relation to post-retirement solutions that provide a sustained income for someone’s lifetime, not just a lump sum at retirement,” said Mr Boyfield.

Mercer produces the Pensioner Mortality Investigation (PMI) every three years. The research analyses the mortality of pensioners of public sector schemes from the Commonwealth of Australia, New South Wales, Victoria, Queensland, South Australia, Western Australia and Tasmania. It is based on data for the decade to 30 June 2012 with a focus on the more recent experience from the previous PMI, from 1 July 2009 to 30 June 2012.

|