By Fiona Tait, Technical Director, Intelligent Pensions

Given this fact and their high-risk reputation is it still worth having a SIPP, or could they be replaced by one of the more modern communal solutions at a reduced cost and with lower risk?

What’s gone wrong

SIPPs give rise to complaints for a number of reasons, but there are 2 key factors that make them particularly susceptible to unsuitable advice:

1. They, together with personal pensions (the third most complained about form of pension), are the most common destination for defined benefit transfers.

2. They allow access to high-risk and unregulated investments which may be inappropriately marketed.

Arguably neither of these issues is relevant to the SIPP wrapper itself – legislation has been notoriously contradictory regarding where responsibility lies between the various parties involved – but there is no denying that both result from the wide scope and flexibility of options available under a SIPP. The more choice people are given the greater the chance that they will make, or be led to, the wrong one. It is however this very flexibility that makes them so useful as part of a retirement plan.

What are they good for

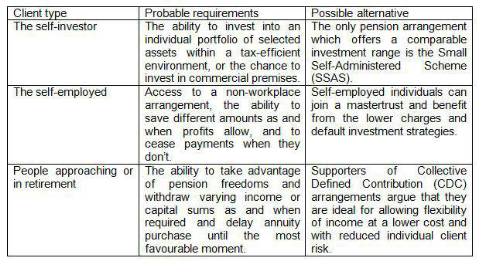

There are 3 key groups of individuals who are most likely to have a SIPP.

Individuality

There is in fact nothing much that a SIPP can offer that could not be achieved using another less risky vehicle, what makes them different is their individuality. Not everyone needs a bespoke suit, but they do fit better, especially if you are a less than standard size or shape.

SIPPs were initially marketed at self-investors, who saw themselves as astute businesspeople capable of playing the market to their advantage or were looking to finance the purchase of specific shares or business property. This in fact limited their appeal since at the time contribution limits were much more generous under a SSAS and these would be preferred by those who could use them.

This difference no longer exists however self-investors still form a relatively small part of the SIPP market.

The true advantage of a wide investment range is not investing in specific assets but the ability to create a balanced portfolio of assets which are capable of meeting individual objectives within acceptable risk parameters. This is particularly valuable when the aim of the plan begins to switch from capital accumulation to income production. A SIPP could be a suitable vehicle for any catch-up contributions, particularly if these monies need to ‘work hard’ to achieve the required rates of return. It may also be useful to consolidate smaller pension pots into a single arrangement to create greater focus on the eventual goals.

Pension freedoms

SIPPs really come into their own for people who want access to their benefits. Both mastertrusts and CDC schemes are capable of offering flexible income solutions but relatively few do so. This may be because they are still relatively new to the market, but it is also more difficult for larger pension arrangements to accommodate individuality. During the accumulation phase this is less of an issue as everyone is just looking to build up as much money as they can; in decumulation it is trickier as withdrawals could be required at any time and in any amount and both the administration and investment strategy has to be capable of supporting this.

It may be that in time the newcomers become much better at offering decumulation options but for the present the SIPP still reigns supreme.

|