by Susan McIlvogue, Head of Trustee DB at Hymans Robertson

Recently, TPR added this concept to their 21st Century Trusteeship campaign which aims to raise standards amongst trustees and improve how schemes are managed. We can expect to see this feature in the forthcoming DB Chair’s Statement which will likely require trustees to undertake a value assessment to prove they are safeguarding members’ benefits.

“It is strongly recommended that DB schemes assess value for members to help ensure good member outcomes” The Pensions Regulator

Why now?

Value for money is already a well-established concept in the world of DC pensions. So why has it only recently become a hot topic for DB schemes? There are 3 key drivers:

Significant deficit – despite £billions being paid into DB schemes, we’re still faced with a huge collective shortfall totalling £500bn.

Scheme maturity – with 75% of schemes cashflow negative, there’s an urgent need to fill the funding gap.

Member security – high profile sponsor failures, such as BHS and Carillion, are a stark reminder that benefits aren’t guaranteed.

Where are the opportunities to create value?

Value for money is often associated with reducing running costs. However running costs are just a dent in a much bigger problem.

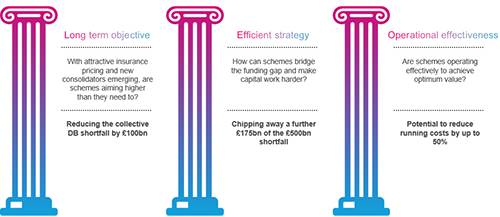

If we want to make a significant difference to the collective shortfall, we must look beyond this. We believe true value creation sits across 3 pillars:

Reviewing your long term objective – you may be closer to your end goal than you think. With attractive insurer pricing and new consolidation vehicles entering the market, member security could be improved at a much lower cost. Reviewing the long term objective in light of these developments could reduce the collective UK shortfall by £100bn.

Adopting an efficient strategy – implement all the tactics available to you to bridge the funding gap more efficiently. For example, through enabling member options at retirement, and implementing a series of strategic buy-ins, you can chip away at your liabilities over time. Additionally, adopting a capital efficient investment strategy has the potential to free up as much as 40% of your total capital, allowing you to create value in a variety of different ways, such as targeting higher returns to reach the finish line sooner, or reducing risk to reach it with more certainty. Adopting these tactics has the potential to reduce the collective shortfall by a further £175bn.

Achieving operational effectiveness – carry out a governance review to ensure you’re achieving maximum effectiveness from your trustee board. Where appropriate, consider the merits of alternative governance structure like a master trust or a merged DB scheme (if you have multiple DB schemes), to further enhance operational effectiveness. Implementing an effective governance model and embracing the use of technology adds real value and is an enabler to access the value creation opportunities under the first 2 pillars mentioned above.

Time to unlock the potential

Our analysis indicates that there’s potential to create £275bn of additional value across UK DB, slashing the UK shortfall by more than half. With the Regulator promoting value for money, now is the time to take action. Schemes should be prepared to be able to demonstrate how they are maximising value and securing better outcomes for members.

|