By Stuart McDonald, Partner, Head of Longevity and Demographic Insights, Andrew Pijper, Consultant and Godspower Oboli, Analyst from LCP

Two decades on, the NHS is facing unprecedented pressure, exacerbated by the direct and indirect effects of the Covid-19 pandemic, and people are spending more years in sickness than ever before. The time felt right for new modelling – inspired by the original Wanless report – to understand how health spending will evolve under various scenarios.

A joint analysis between the Institute for Public Policy Research (IPPR) and LCP Health Analytics compared the projected cost of government-funded healthcare to 2033/34 under various morbidity, productivity and inflation scenarios. These help us understand how demand for healthcare is evolving and to identify reforms needed to ensure the NHS remains affordable over the coming decade.

A model of healthcare spending

Our modelling informed the report for the cross-party IPPR Commission on Health and Prosperity: Reforming health and care, for public health and public finances. The report advocates for reform to health and care services to shift the NHS from a sickness service to a prevention service, focused on effectiveness rather than just efficiency, and so improving both public health and public finances.

The model is based on projected changes in population demographics, and analysis of age-, sex- and specialty-specific trends in healthcare service utilisation and unit costs since 2004/05 in England.

We took care to ensure that the model is grounded in up-to-date real-world information, making use of extensive publicly available data from both primary and secondary care. Additionally, we incorporated information regarding care in external settings, such as community care.

Our projections did not specifically account for the impact of Covid-19, due to the uncertainties regarding the pandemic's long-term effects on healthcare demand. While our growth rate aligns with pre-Covid trends, the baseline data for 2022/23 is derived from the Department for Health and Social Care’s 2021/22 annual report and accounts, suggesting that the increased spending required since the start of the pandemic may represent the new norm.

The road ahead: scenarios for the future

We modelled a range of scenarios for the future development of the healthcare system, three of which are explored in IPPR’s report:

Repeating history: if productivity and other factors grow in line with historic trends, we would expect government-funded healthcare costs* to reach 10.7% of GDP in 2033/34.

Post-pandemic new normal: if productivity flatlines, we would expect expenditure to reach 11.2% of GDP in 2033/34.

Reform: if productivity grows 0.5% pa faster than historic trends and healthy life expectancy begins rising from 2027/28 in line with the gains seen in the 2000s, we project expenditure of 9.9% of GDP in 2033/34.

The difference in cost in 2033/34 between the post-pandemic new normal scenario (£370bn) and the reform scenario (£326bn) is £44bn. For a sense of scale, this is almost the equivalent to the current UK defence budget. Of this, £35bn relates to improvements in productivity (assumed to be 1% pa in the reform scenario), with the remaining £9bn due to improvements in healthy life expectancy, illustrating the longer-term benefits of shifting to a prevention-first healthcare model.

The repeating history scenario projected healthcare costs in England to be £352bn in 2033/34. This compares with incurred costs of £191bn in 2022/23, a nominal growth rate of 5.7% pa. Of this projected growth, 2.6% pa is due to inflation of unit costs, 2.3% pa is from increases in underlying resource utilisation (reflecting observed trends), 0.4% pa relates to population ageing and 0.3% pa to population growth.

The future is uncertain

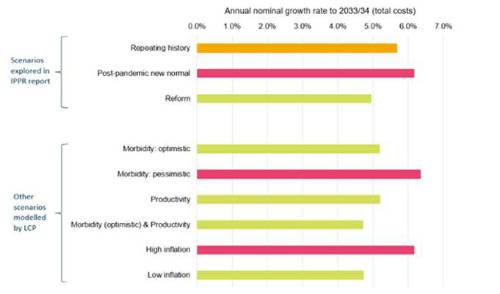

As well as the scenarios presented in the IPPR report, we explored the impact of other scenarios on healthcare growth. This included different inflation environments, shifts in the population's morbidity profile, and further variations in healthcare productivity. A concise overview of the outcomes from different scenarios is presented in Figure 1. Further details about the assumptions underpinning each of the scenarios can be found within the report.

Reflections

Our modelling illustrates the significant impact that individual components, such as morbidity profile and productivity have on future healthcare expenditure and the financial sustainability of the NHS. A societal focus on prevention of illness, and on NHS effectiveness rather than just efficiency, could improve both public health and public finances. As we look beyond our current projections and towards 2050, the case for prevention only gets stronger.

*We have modelled Government healthcare expenditure (excluding long-term residential care) in England. We exclude private healthcare and long-term residential care, both of which are included in ONS estimates of healthcare expenditure as a share of GDP.

|