Why thinking outside the cash box could benefit long-term investors

With yesterday's Bank of England meeting minutes showing that the Monetary Policy Committee unanimously voted to maintain the base rate at 0.5% this month, there seems little prospect of an improvement in the dire situation for cash savers. Indeed, after the European Central Bank cut a key interest rate to zero last month, there is speculation that the Bank rate could even reach 0.25% next month.

The interest rate on the best-buy instant access cash deposit without an introductory bonus (according to Moneyfacts at 15 August 2012) was 2.6%, which is a great deal better than the Bank rate, but with Tuesday's inflation data showing the Consumer Prices Index at 2.6% too, the real return on even the top-paying rate would be zero.

So while cash is still king for everyday and rainy-day funds, investors in search of a more meaningful return may need to move further up the risk spectrum. With yields on many government bonds also close to zero, the best potential returns - albeit with a higher risk of capital loss - will arguably come from equities.

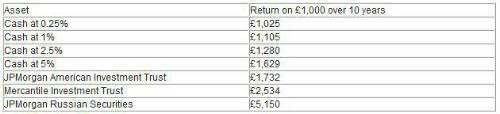

Source: J.P.Morgan Asset Management/Morningstar. Past performance is not a guide to the future. Cash returns are notional and based on compound interest without allowing for inflation. Investment trust returns are actual net asset value total returns over 10 years to 30 June 2012. Final figure includes the £1,000 initial investment.

The three J.P. Morgan Asset Management-run investment trusts in the above table illustrate the wide divergence of returns on offer from equity markets, although even the worst-performing would have beaten a 5% cash deposit over the period. JPMorgan American invests in large US companies, while Mercantile broadly invests in UK dividend payers (showing the importance of reinvesting dividends) and JPMorgan Russian Securities invests in the often volatile but resource-rich Russian market.

Keith Evins, Head of UK Marketing at J.P. Morgan Asset Management, commented: "While cash definitely has an important place in people's lives, too often savers are put off diversifying into equities by the risk of loss. What they don't focus on is the opportunity cost of clinging to cash - that is, the returns they might miss out on. Of course, stockmarkets go down as well as up, and there is no guarantee that returns will beat those on cash, but equity investing is a long-term game, and over the long term equities have beaten cash time and time again."

Keith Evins added: "For those investors who do want to dip a toe in the waters of equity investment, an online investment platform such as J.P. Morgan WealthManager+ can allow them to start small, with regular investment available from £50 a month, which can also have the benefit of spreading risk by avoiding committing funds just before a dip in the market. With a wide range of funds and investment trusts available on the platform, and a choice of wrappers including an Individual Savings Account (ISA) and a Junior ISA, investors can choose the investment strategy and tax structure that best suits their needs."

J.P. Morgan WealthManager+

The J.P. Morgan WealthManager+ online platform allows customers to access a number of financial planning tools, such as the financial health check and a tool to evaluate attitude to investment risk to help with investment decisions. It is ideal for investors who want to take control of their financial future offering a wide selection of investments including OEICs, SICAVs and investment trusts from J.P. Morgan as well as funds from other leading fund managers, UK equities and ETFs. Investments can be held in an ISA, SIPP or directly in an Investment Account.

|