Columbia Threadneedle Investments carried out a recent survey of 800 UK adults to investigate the level of financial resilience in the face of the pandemic. These results are attached.

Our findings show the negative impact of the immediate financial shock but also reveal some reasons to be optimistic. While many regret their past financial decision-making, to what extent will current events lead to a re-think when it comes to how we navigate our financial future, including greater emphasis on individual financial planning and professional advice?

Findings include:

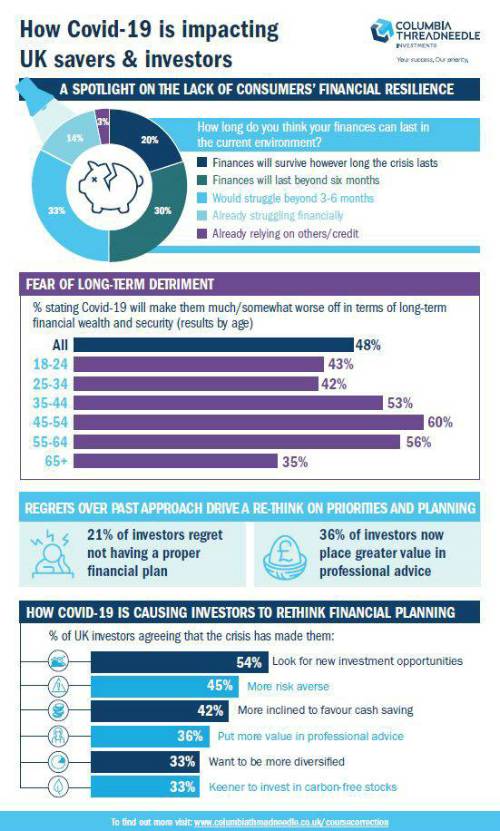

• Nearly half of all people feel that Covid-19 will leave their long-term wealth and well-being in a poorer state than would otherwise have been the case. This is particularly felt by those aged 35-64

• 49% of people hold regrets about the way they had organised their finances before the crisis hit. Younger people are far more likely to regret their previous arrangements – as many as 72% among 18-24 years olds and falling to 19% among the 65+ group

• Of those that invest, Covid-19 has shifted attitudes: 45% saying it has made them more risk averse, and conversely, 54% saying it presents new opportunities. A third said it made them keener to invest in carbon free stocks and 36% more inclined to favour cash savings. However, 36% say it has made them put more value in financial advice.

Full Report on How COVID19 is Impacting UK Savers and Investors

|