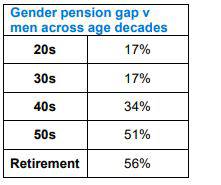

The staggering impact of the gender pension gap has been revealed in new research which shows that women have lower pension pot sizes in every age bracket, with the situation significantly deteriorating as they approach retirement.

The research, which analyses data from approximately 4 million Legal & General (L&G) pension scheme members, shows that there is always a difference in pension pot sizes between genders, even at the start of men and women’s careers. This initial gap (17%) remains largely unchanged until men and women reach their thirties, but doubles to 34% by the time they are in their forties. The gap increases to 51% in the fifties age bracket, and then to 56% at retirement. The research, which analyses data from approximately 4 million Legal & General (L&G) pension scheme members, shows that there is always a difference in pension pot sizes between genders, even at the start of men and women’s careers. This initial gap (17%) remains largely unchanged until men and women reach their thirties, but doubles to 34% by the time they are in their forties. The gap increases to 51% in the fifties age bracket, and then to 56% at retirement.

Looking specifically at people’s pension pots at the point of retirement reveals the extent of the discrepancy. L&G looked at the size of pension pots of more than 37,000 people in the UK who retired in 2020. Of these, the average size of a man’s pension pot at retirement is £21,000 compared to £10,000 for a woman – a difference of more than half.

The analysis reveals that the difference in size of pot has a significant influence on the choices being made at retirement. 92% of women choose to take their pension in cash compared to 86% of men, while only 7% of women consider a drawdown compared to 12% of men.

The issue is compounded by the fact that even in industries where women are more heavily represented in the workforce, the pension gap remains just as stark. For example, in the Senior Care sector, the research shows that 85% of pension scheme members are women, yet the average woman’s pot size is 47% smaller than the average man’s (£8,040 current male average pot size).

Rita Butler-Jones, Co-Head of DC at Legal & General Investment Management says: “DC pensions have grown substantially in recent years, with auto-enrolment becoming a huge success. However, much like the Gender Pay Gap in wages, the Gender Pension Gap is fast becoming an issue which needs to be higher on our radars as an industry. This analysis of more than 4 million of our members reveals the extent of the gender pension gap in the UK – a gap that exists right from the very beginning of a woman’s career and accelerates as she approaches retirement. The decision to take a career break to raise a family has a clear impact, though there a number of other factors at play here including lower pay relative to male peers at all stages of a woman’s career, a lack of pension contributions when she is away from the workplace, and the potential impact that raising a family has on a woman’s career progression. Women are also more likely to face financial struggles following a divorce from their partner and are significantly more likely to waive their rights to a partner’s pension as part of their divorce. This is particularly true for older women, with one in four divorces occurring after the age of 50.”

Stuart Murphy, Co-Head of DC at Legal & General Investment Management says: “Events over the last year have also shone a spotlight on those who juggle day jobs with keeping a household running. Changing social and workplace attitudes should help begin to level the playing field in terms of responsibilities, helped by the increasing acceptance of more flexible working patterns.

The gender pay and pension gap is a complex issue that will take time to solve. We need to see increased support from the state and employers in levelling the playing field by looking at issues such as lowering the eligibility age and raising the minimum contributions for auto-enrolment, as well as addressing the pay gap for part time employees.”

L&G will review the data on an annual basis to establish whether the Gender Pensions Gap is widening or narrowing. As the pensions leader, L&G will encourage the industry to collaborate on this urgent issue, with the aim of producing a clear plan to narrow the gap. As a first step, this will include pressing for a lowering of the auto enrolment threshold to encourage more women into auto-enrolment; especially in those cases where there are multiple jobs earning less than £10k and women are ineligible for auto enrolment, with the consequence that they miss out on employer and tax support. Alongside this, L&G believes that the industry should engage with the Money & Pensions Service (MaPS) on how to better communicate the important benefits of pension saving for women at all stages in their working lives.

|