• Gulf between male and female saving begins to emerge as savers hit their 30s

• 37% of women with dependent children feel pessimistic about their financial future, compared to 26% of men

• 71% of women have no idea how much they need to save for retirement, compared to 52% of men

Whilst 26% of women and 30% of men in their 20s think they are preparing adequately or more than adequately for retirement, this four percentage point gap increases by a further 11 percentage points in the 30s. By this point, 48% of men believe they are saving adequately, compared to just 31% of women.

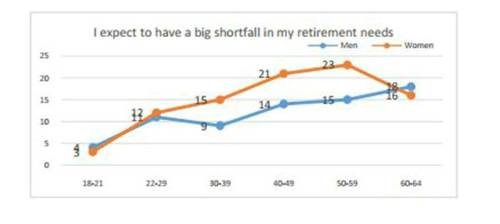

Additionally, while the number of women expecting a big shortfall in retirement shoots up by 10 percentage points between their 20s and 40s, the proportion of men expecting a shortfall rises by just 3% over the same period. This is a reversal of the trends seen during their 20s, when men are more worriedthan women about their retirement income failing to meet their needs.

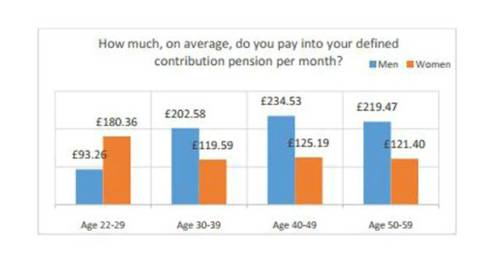

The levels of optimism shown by women in early adult years are mirrored by their saving habits, as women pay more into workplace schemes than men in their 20s. Of those paying into a workplace pension scheme, men are putting away an average of £93.26, whilst women are saving around £180.36 at this age.

However, despite positive signs of early engagement, saving levels then drop as women get older, whilst men put away more. Shifting priorities: balancing work and family life Starting a family has a more noticeable impact on women’s ability to save due to lower income, as 27% of women with 1-3 dependent children work part-time, versus 6% of men. Given the current average age for women in the UK to begin having children is around 30, there is a clear link between the dip in financial optimism and saving levels at this age with new financial challenges juggling work and family.

The findings also revealed that women with children worry more about their finances than men, as 37% of women with 1-3 dependent children feel pessimistic about their long-term financial future versus 26% of men in the same position. Having children has almost a negligible impact for men, with only 1% fewer men who have children feeling optimistic about their long-term financial future than those who do not (45% versus 47%). The‘positivity’ gap for women is much wider (30% for those with children versus 38% without), and optimism is noticeably lower across all age groups. Aside from feelings about saving and preparing for retirement, 35% of women with 1-3 children also feel pessimistic about their short-term financial situation, compared to 22% of men.

Gulnur Muradoglu, behavioural finance expert, said: “The fact that women save more than men in their twenties and then drop off in their thirties is actually reflective of their behaviour and attitudes towards their finances in general. By nature, women are more conservative and risk-averse than men, so as they are aware that they are going to be less likely to save in their thirties due to the impact of career breaks, women ensure that they are plugging this gap by ramping up saving in their twenties.

Women are also more realistic than which may explain their higher levels of pessimism about what their income expectations are for retirement.” Lack of financial awareness Women’s unique circumstances in the workplace are not the only thing having an impact on their ability to save, as the research revealed that women are also are less engaged with saving compared to men as they get older. Overall, almost three quarters (71%) of women also don’t know how much they would need to save for what they would consider to be a comfortable retirement, compared to only half (52%) of men.

However, whilst a quarter (24%) of both men and women aged 18-21 have no idea of the extent to which their pensions, savings and investments will meet their retirement income needs, by the time savers reach their 40s, this has dropped to 21% amongst men, but rises to 29% amongst women.

Gulnur Muradoglu added: “Research on women and their financial behaviour is limited, so it is important that this sort of robust insight is used to help shape discussions around how we encourage women to better engage with their finances. More needs to be done to understand the savings and investment behaviour of women; rich and poor, working and not working; singles and couples; with and without children – and how financial products and advice can be adapted accordingly.”

Jackie Leiper, retirement expert at Scottish Widows, said: “When it comes to attitudes towards retirement saving, young men and women appear to be almost on a par, yet our research has identified an alarming divergence in the 30s which needs to be addressed. Whether it’s having a family, taking a career break or changing working patterns, we need to ensure that these life changes impacting women do not jeopardise their future security. This is particularly important given the decision to freeze the auto-enrolment threshold at £10,000, which is estimated to have excluded around 170,000 people from auto-enrolment, of whom 120,000 (69 per cent) are women.

"The need for pension providers, the government and employers to offer more targeted engagement, education and support for women is becoming more prevalent as they navigate their way through the complex savings environment, often juggling the demands of family and work. This should include thinking about specific timings of the information to ensure that women are more engaged and in tune with how what they put away now translates into greater financial security in future."

|