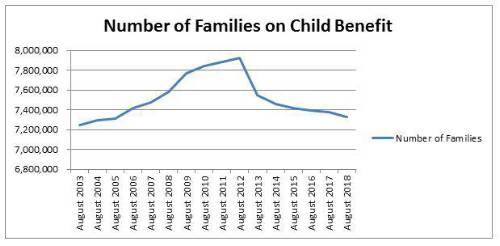

In the summer of 2012 (before the rules changed) there were 7.92 million families on Child Benefit, and that number has now fallen to 7.33 million. Recent trends are shown in the Chart:

Source: HMRC annual statistics

This is as a result of two factors:

- Families who were already in the system when the rules changed ‘opting out’ of child benefit to avoid a tax bill;

- Growing numbers of new families started since 2012 never making a claim for child benefit; the new statistics show that the number of *children* aged 0-5 on child benefit has fallen by 639,000 in the last six years;

A new table, not previously published by HMRC, shows that women account for *almost all* of the fall in new claims for child benefit since 2012. In the year to August 2012 there were 340,000 new claims to child benefit made by women and around 75,000 made by men. By August 2018, the number of new claims by women had slumped to 274,000, a fall of roughly 66,00, whilst the number of claims by men was 72,000, a fall of just 3,000. This is the clearest evidence yet that this issue is hitting women the hardest.

Commenting, Royal London Director of Policy Steve Webb said: ‘This is yet more damning evidence of the collapse of the system for protecting the pension rights of parents. No-one should face poverty in retirement because they spent time at home bringing up young children. Huge numbers of families with young children are now missing out and the Government now needs to act with urgency.

Without action, hundreds of thousands of mothers in particular are set to face retirement poverty’.

Where parents make no claim for child benefit, they risk missing out on vital National Insurance credits towards their future state pension. For as long as the parent claiming child benefit is not in paid work, the child benefit claim is the only thing that is protecting their state pension rights. The big drop in the number of 0-5 year-old children on benefit shows how many new families formed since 2012 have simply not claimed the benefit. As the large majority of Child Benefit claims which are made are made by women, this suggests that it is overwhelmingly mothers who are missing out on future state pension rights.

One year of missed contributions can reduce state pension rights by 1/35 of the full rate. This is around £244 per year of lost pension or just over £4,880 over the course of a typical twenty year retirement for each year of contributions missed. A mother who started a family in 2012 and has not claimed Child Benefit in each year from 2012/13 to 2017/18 could have lost up to six years of credits, reducing her annual state pension by £1,464, a total of just under £30,000 in lost pension through her retirement.

Mutual insurer Royal London has calculated that the cumulative amount lost by parents not claiming now amounts to hundreds of millions of pounds. The firm has launched a Parliamentary petition on this issue which has already attracted more than 13,000 signatures. The petition calls for the three month time limit on backdating of claims for child benefit to be lifted, so that those who have missed out since 2013 can put things right.

|