The combination of the recent rise in gilt yields, positive market performance, gender neutrality changes, and the 20% uplift in income levels announced by the Government earlier this year, can provide a substantial boost to the level of income available for female pensioners. Those taking income drawdown could see their maximum income level increase by as much as 67% on the previous year.

For those clients currently in a three year statutory review period the 20% uplift in the maximum annual income will happen automatically at the start of the next scheme income year following the 26th March 2013. It is important, however, that women understand any uplift as a result of the other factors will not happen until a recalculation point is triggered within the pension.

A recalculation point will be triggered automatically at the next statutory review point, but for some this could be up to three years away, during which time some factors may no longer be as beneficial.

One simple and effective way for females to trigger a recalculation point is to opt for an annual review facility with their product provider, if this facility is offered within their scheme. An annual review will give them the option, but not the obligation, to have income recalculated in line with current advantageous gilt yield comparatives and the increased capital value of their drawdown fund.

This could provide a win-win situation; if circumstances improve, people can benefit from those changes sooner than waiting for their next statutory review. They can lock in the higher income entitlement for a new three year period from the start of their next scheme income year. However, if things have worsened, there is no obligation to accept a lower income level.

For those clients who started income drawdown on or after 6th April 2006 another way of triggering a recalculation point is to move more pension savings across into the drawdown fund. If all the pension savings are already held in drawdown, it could be beneficial to make a new pension contribution (if they are aged under 75). This new pension fund can then be dripped down into drawdown and a new calculation point triggered.

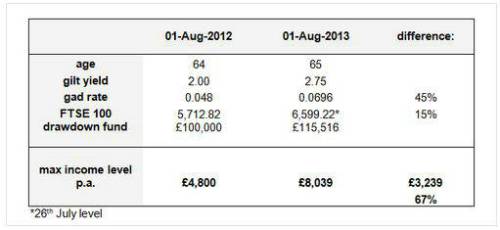

Example calculation demonstrating the 67% increase:

The example below assumes a female has £100,000 in a drawdown fund, invests in the FTSE 100 Index, and the index level stays constant (as at the 26th July level). Due to the increase in age, rise in the gilt yield, and increase in drawdown fund (assuming no capital was withdrawn) the amount of income available increases from £4,800 p.a. to £8,039 p.a. - an increase of 67%!

Adrian Walker, Skandia’s pension expert, comments:

“Retirees in capped income withdrawal, particularly women, have a real opportunity at the moment to plan ahead to receive more income from their pensions. The stars have aligned to a certain extent with gilt yields improving, the government changing the maximum income rules and the benefit of gender neutrality now in force. Activating an annual review or topping-up their drawdown fund are the simplest ways for females to benefit from these changes sooner rather than later, with no downside.”

See more here

|