Kate Smith, Head of Pensions at Aegon gives her top tips for addressing the gender pension gap. The latest Aegon Second 50 research has revealed significant gender disparities in retirement confidence and reliance on State Pension among UK retirees, underscoring the financial challenges faced by women in their later years. The findings indicate that many women may be realising the financial realities of retirement too late.

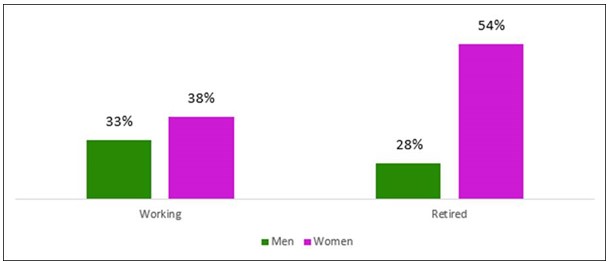

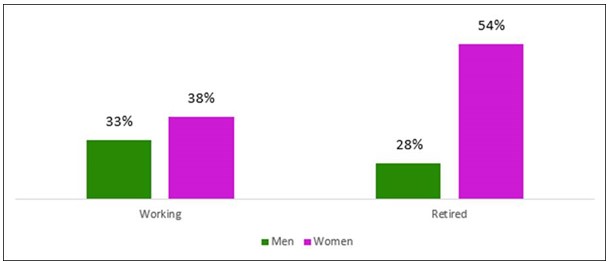

A key finding from the survey shows that there is relatively little difference between working men and women in their expectations of relying on the State Pension for their retirement income. Specifically, 38% of women and 33% of men anticipate that the State Pension will be a significant or their only source of retirement income.

However, the situation among current retirees paints a starkly different picture. Over half (54%) of retired women report that the State Pension is an important or their only source of retirement income, compared to just 28% of retired men.1 This disparity highlights the greater financial vulnerability faced by women in retirement.

Chart: Reliance / expected reliance on State Pension in retirement

Source: Data conducted by H/Advisers Cicero on behalf of Aegon, July 2024.

Source: Data conducted by H/Advisers Cicero on behalf of Aegon, July 2024.

Question: To what extent do you rely on the State Pension in your retirement?

The survey also reveals that the concerns of working-age women about their financial security in retirement often become a reality. Fewer than one in three retired women (32%) feel extremely or very confident in always being able to live a comfortable lifestyle in retirement – a proportion far smaller than we see among retired men (46%).

Adding to this, data recently released by the Office for National Statistics (ONS) on 'sandwich carers' — those with dual responsibilities for dependent children and adult relatives — further highlights the gender disparities and the associated mental health and confidence struggles. The ONS reports that around half (53%) of sandwich carers are unable to work at all or as much as they would like due to their caregiving responsibilities, which contributes to inadequate retirement income. Additionally, 61% of sandwich carers are women, underscoring the significant gender imbalance in caregiving roles and the disproportionate impact on women’s careers and financial stability.

To highlight these findings, Aegon has launched ‘The Second 50: Addressing the gender pensions gap”. This guide aims to shine a light on the significant impact that confidence and security in later life have on women’s decision-making. It also offers practical tools and strategies to help women prepare financially and mentally for their later years, ultimately working towards bridging the gender pensions gap.

Kate Smith, Head of Pensions at Aegon said: “These findings are a wake-up call for all of us. The stark reality is that women are disproportionately affected by financial insecurity in retirement. Our research shows that almost double the percentage of retired women (54%) compared to retired men (28%) rely on the State Pension as an important or only source of income in retirement.

“This disparity shows that many women may have fewer savings and might have prioritised immediate financial needs over long-term planning, potentially leading to greater financial dependence on their partners. However, with the introduction of automatic enrolment almost 10 years ago most jobs now come with a pension, which has changed the future retirement landscape for women. This shift highlights the ongoing importance of practical and forward-thinking financial planning. State Pensions play a vital role for nearly everyone, but they should not be the sole source of retirement income. It is essential for women to engage in both independent and joint financial planning.

Our new guide is designed to empower women with the information and resources they need to plan effectively for retirement. By taking control of their own financial future and having open discussions with their partners, women can look forward to enjoying their later years with confidence and security.”

Kate’s top tips for addressing the gender pension gap:

Understand what makes you unique

• Recognise the opportunities and challenges you face as a woman.

• Plan for periods where you might reduce working hours or take career breaks for caregiving.

• Factor in potential time off and medical costs, including those related to menopause.

Ensure joint plans consider your individual needs

• Don’t take a backseat in planning for your later life.

• Make sure joint financial plans with your partner include your personal goals and requirements.

• Plan for the possibility of becoming the household’s sole provider to maintain financial independence.

Look after your pension during times of change

• Be aware of the impact of part-time work and career breaks on your retirement savings.

• Try to contribute to your pension, even during reduced working hours.

• Find a balance that allows you to save for the future while meeting present needs.

• Consider ways to make up for any gaps in your savings.

|