LCP researched the main master trusts active in the UK workplace pension market and, as part of that research, examined the makeup of the trustee boards which oversee the schemes. Between them, master trust boards are currently responsible for managing around £130 billion in assets spread across around 25 million accounts.

On gender, LCP found that 46% of trustees are female. This is actually six percentage points higher than the proportion of board members of FTSE 350 companies who are women. It broadly matches the gender split of the membership of a typical master trust, with NEST, for example, reporting that 47% of its members are women.

However, the research found that in other key respects, trustee boards are much less representative of scheme membership.

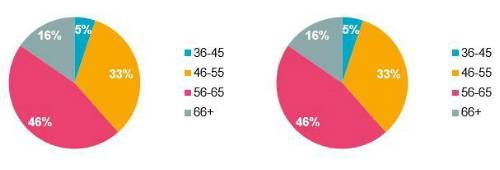

On age, as the chart shows, LCP found that trustees tend to be much older than the membership which they serve:

Chart: Age distribution of members of master trust boards

Trust boards were also found to be unrepresentative of the wider population when it comes to ethnicity. LCP found that 98% of trustees are white, with just 2% from a minority ethnic background. By contrast, the 2021 census found that in England and Wales, only around 82% described their ‘high level’ ethnicity as white.

Commenting on the research, John Reid, Principal in LCP’s DC and Financial Wellbeing Team, said: “It is welcome to see a good gender balance on the boards of master trusts, but much more needs to be done when it comes to other aspects of diversity.

Although members will want to see good levels of experience on trust boards, there is a risk that if trustees are typically much older than members, they may not fully see issues through the eyes of their younger members. Similarly, there may be issues of particular importance to scheme members from ethnic minority groups which will not be fully appreciated by an overwhelmingly white board. As trustee board membership evolves, more attention will need to be given to these wider aspects of diversity.”

|