Under current rules, anyone who comes under the new state pension system (those reaching pension age after 5th April 2016) can fill gaps in their NI record at especially favourable rates. But these concessionary rates expire on 5th April 2019 after which filling those same years could cost several hundred pounds more in total. Those who are thinking of filling gaps, and – crucially - who have checked that they will boost their state pension by doing so, can save money by acting before the end of the current financial year.

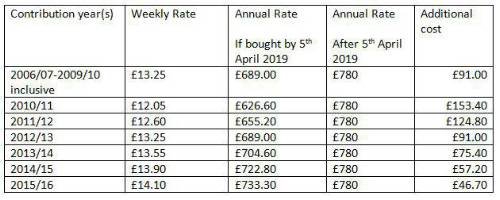

At present, anyone covered by the new state pension system with a gap in their National Insurance record for any year from 2006/07 to 2015/16 has until 5th April 2023 to fill those gaps. On the face of it, this means that there is no rush to do so. However, under a special concession, those who pay voluntary contributions by 5th April 2019 qualify for special rates. In 2019/20 the normal rate for buying back one week of NI contributions will be £15. But, as the Table shows, different rates are charged for those acting now:

Sources:

https://www.gov.uk/voluntary-national-insurance-contributions/rates

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/709421/Table-a4.xls

The Table shows that someone wishing to fill a gap for 2010/11 will save over £150 by acting before 6th April. Someone wishing to fill six years from 2010/11 to 2015/16 would save over £500 by acting now.

Those considering topping up should however check that doing so will actually boost their state pension, as complex transitional rules mean that this will not necessarily be the case. They can do this by contact the DWP Future Pension Centre whose contact details are at: www.gov.uk/future-pension-centre . Royal London has produced a guide to topping up state pensions which explains more about the process and can be found here

Commenting, Royal London Director of Policy Steve Webb said: ‘For many people, topping up their state pension through paying voluntary NICs can produce a good rate of return because the cost of doing so is subsidised by the government. But the price of voluntary NICs will rise sharply in April so those considering doing so may wish to act quickly and could save hundreds of pounds by doing so’.

Jon Treharne, Managing Director of Shore Financial Planning is encouraging fellow financial advisers to draw this issue to the attention of their clients. He said: “Many people will be unaware that the cost of filling historic gaps in their National Insurance record is due to be hiked in April. I would encourage anyone thinking of filling such gaps and who has checked that they will increase their pension by doing so, to consider whether they would be best advised to top up before 6th April”.

|