The impact of a lack of cover is all the more pronounced given the research suggests two thirds of women aged 25-45 have dependent children with 40% in the process of paying back a mortgage. A further 35% do not own their own home, meaning three quarters in total would likely be liable for helping to fund housing costs.

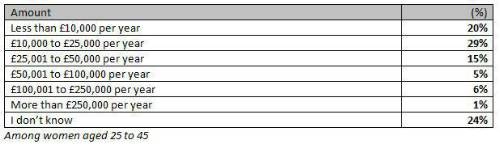

When asked to estimate how much their absence would cost their household if they were no longer able to contribute, for example if they were to fall ill, 29% believe this would be between £10,000 to £25,000 per year, although a similar proportion (27%) believe the total cost could be higher. This suggests a loss approaching the average UK disposable household income (£27,300) and includes factors such as no longer being able to help with housekeeping and childcare as well as lost salary or wages.

Table 1: If you were no longer able to contribute to your household for any reason, how much extra do you think your absence would cost your household?

Half of women have not even considered the need for protection

With women accounting for nearly half of the UK workforce in 2018[2], they play a significant role in making financial decisions – only 6% of cohabiting or married women aged 25-45 say their partner makes the majority of financial decisions, with 46% doing so with their partner equally and 48% making decisions independently.

Yet more than half (57%) of women in this age group have not taken out any kind of individual protection and a similar proportion (50%) say they have never considered their need for protection and are not planning to do so in the near future. A third (34%) do admit they would be prompted to do so by a personal experience, such as the loss of a friend or a loved one. This lack of engagement suggests women have not been well-served by industry approaches to improving uptake of protection products.

Natalie Summerson, National Sales Manager for Individual Protection at Canada Life and a founder member of the Women in Protection group, comments: “With up to £25,000 at stake for UK households, it is alarming to see that so many women have never even considered taking out individual protection insurance, be it life insurance or critical illness cover.

“Given the emotional strain of a loved one falling ill or passing away, families should not have to also worry about the financial implications of one less person contributing to the household, or be forced to rack up debt that could follow them for a lifetime.

“As an industry and society we need to acknowledge that women are not just a crucial part of the UK workforce, but are also contributing a critical amount to their household, through income and other forms of support such as childcare or running a home.

“The need for protection is high and women need to be encouraged and enabled to take care of themselves and their families should the worst happen. We will be continuing to investigate how best to reach women and provide them with the protection they need in a way that works for them.”

• For International Women’s Day, Canada Life explores the protection gap among women aged 25-45

• Women in this age group have significant financial responsibilities, with two thirds having children under 18 and 40% paying back a mortgage

• Should they fall ill or die, they estimate their household could lose up to £25,000 per year (49%) or more (27%)

• Despite this, half of those women surveyed have never considered their families’ protection needs and 57% do not have protection in place

|