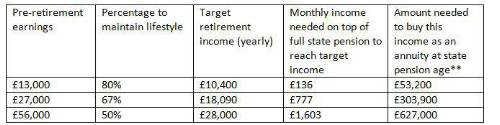

A government review of auto enrolment in 2017 set out what proportion of pre-retirement earnings individuals would need to maintain their lifestyle in retirement (target replacement rates)*. For someone earning around £13,000 the percentage needed to maintain lifestyle was 80%. For those earning around £27,000 the percentage is 67% and this falls to 50% for those earning around £56,000.

Aegon has calculated the monthly income individuals would need on top of the full state pension (£168.60 per week) to maintain their lifestyle in retirement.

Pre-retirement earnings Percentage to maintain lifestyle Target retirement income (yearly) Monthly income needed on top of full state pension to reach target income Amount needed to buy this income as an annuity at state pension age**

Table 1 – Monthly income needed on top of a full state pension to maintain lifestyle in retirement and how much it would cost to buy this at state pension age (68).

These are significant sums and the sooner people start saving towards them the better. Automatic enrolment minimum contributions made by individuals and their employers to workplace pension schemes will help, but are unlikely to bridge the full gap.

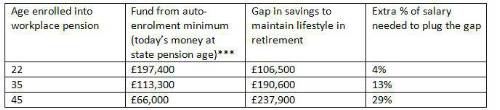

The savings pot auto-enrolment will deliver and the amount needed to close the replacement rate gap

For an employee on average earnings of around £27,000, Aegon’s calculations show how much they might build up from minimum automatic enrolment contributions. We then calculate the additional contribution needed on top to plug the gap in savings and reach the target income needed to maintain their lifestyle in retirement (targeting £303,900 in today’s money).

Age enrolled into workplace pension Fund from auto-enrolment minimum (today’s money at state pension age) Gap in savings to maintain lifestyle in retirement Extra % of salary needed to plug the gap

Table 2 – Table showing the additional contribution needed on top of the statutory minimum levels for auto-enrolment and state pension for an employee earning £27k to plug the gap in savings in order to maintain their lifestyle in retirement

Steven Cameron, Pensions Director at Aegon said: “Maintaining your lifestyle throughout your retirement years is something many people aspire to. But for most individuals, this will not be the reality if they are simply being auto enrolled into their workplace pension. Someone earning £27,000 should be aiming for an annual income in retirement of around £18,000 in today’s money to maintain their lifestyle. While the state pension will on current terms provide around £8,767 of this, and being automatically enrolled will also produce a valuable fund, they still face a major shortfall and the longer people wait to address this, the harder it is to catch up.

“Someone who is auto enrolled into a workplace pension from age 22 might still face a gap of £106,500 in today’s money. To plug that, they might need to pay in an extra 4% of earnings on top of the 5% they are currently required to pay under auto enrolment. But someone without any prior pensions auto enrolled at age 35 would need to pay an extra 13%.

“While these extra amounts may seem daunting, some employers will ‘match’ any additional employee contributions with an equivalent employer contribution. In addition, the Government grants tax relief on employee contributions, This can mean it can cost as little as 1.6% from take home pay to have 4% paid into your pension.

“The best chance of getting close to maintaining your lifestyle in retirement is to start paying more than the automatic minimum from as early as possible. It can pay to seek advice to ensure you are on track for the retirement you aspire to.”

|