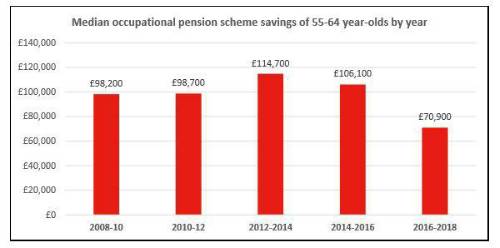

Median occupational pension savings for 55-64-year-olds remained relatively constant between 2008 and 2012, hovering around £98,000 and £99,000 before rising to £115,000 and £106,000 in 2012-14 and 2014-16, respectively.

However, in 2016-18, average savings have collapsed falling to just £71,000 for this age group, decreasing by over 38% or £44,000 since the peak in 2012-14. It raises fears that millions could enter retirement without the means to sustain themselves and leave them relying on State Benefits to cope financially.

The advent of auto-enrolment in 2012 and the introduction of DC pension freedoms in 2015 may also have had an impact according to Duncan Watson, CEO of Equiniti’s pension business, who commented: “It is alarming to see so many people within ten years of reaching the State Pension Age are looking likely to enter retirement with so little reserved in their occupational pension savings.

“Innovation through auto-enrolment and pensions dashboards will transform the pension industry in this country, but this will be of little comfort for those whom will largely be unable to benefit from the reforms.

“Nonetheless, it should act as a warning light for those just starting out in their careers and on their pensionsaving journey. Starting to contribute to a pension is the hardest part in having to sacrifice a chunk of the monthly pay-cheque, but it will become second nature and will make a huge difference to the quality of life people can afford forty years down the line. Your future self will thank you.”

The 25th percentile of pension savers shows an even bleaker picture with at least a quarter of 55-64-year-olds having built up savings of just £8,500 ahead of their retirement, a figure which has more than halved from £20,700 in 2014-16.

|