Risk leaders are struggling to identify and manage the major risks facing their organizations, according to the biannual Aon Global Risk Management Survey released today from Aon Risk Solutions, the global risk management business of Aon. The report unveiled the top 10 risks as well as hidden risks facing organizations today, illustrating the importance of no longer evaluating risk in isolation but considering the relation of risks to establish and maintain a successful risk management program.

The 2013 Aon Global Risk Management Survey points to a significant decline in risk readiness among many of the survey respondents. On average, reported readiness for the top 10 risks dropped a material 7 percent (from 66 to 59 percent) from the 2011 survey and reported loss of income increased 14 percent. Of the 28 industries defined in the report, only three industries – pharmaceutical and biotechnology, non-aviation transportation manufacturing and agribusiness – reported the same or improved levels of readiness this year.

"One possible explanation of the decline in risk readiness could be that the prolonged economic recovery has strained organizations' resources, thus hampering the abilities to mitigate many of these risks," said Stephen Cross, chairman of Aon Global Risk Consulting. "Our survey revealed that, despite diverse geographies, companies across the globe shared surprisingly similar views on the risks we are facing today – whether or not they feel prepared."

Aon saw the number of respondents to its latest Global Risk Management Survey jump to more than 1,400 – a 47 percent increase from its 2011 Global Risk Management Survey. This indicates that companies continue to have a higher level of attentiveness to risk management. The 2013 survey ranked the top 50 risks companies face, focusing on the top 10 risks in 2013 and how they may change in 2016.

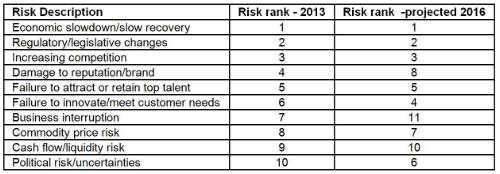

Economic slowdown/slow recovery, regulatory/legislative changes and increasing competition are not surprisingly the top three risks in 2013 and 2016. These risks also take top spots on the risk rankings for the survey's five main regions, which include Asia Pacific, Middle East and Africa, Europe, Latin America and North America. These same three risks are also among the top risks for 24 of the 28 industries surveyed. This ranking reflects the systemic nature of these risks and the high interdependence of global economic activity.

Political risk/uncertainties broke into the top 10 risks for the first time in 2013. Due to the increasing civil wars and social and political conflicts around the world, this risk is projected to move up to number six in the 2016 survey. Weather/natural disasters, while not far off the radar at a current ranking of number 16, is also projected to jump into the top 10 list at number nine, given the unusual climate patterns worldwide and an unprecedented increase in natural disasters and weather events. Failure to innovate/meet customer needs is an increasing priority, projected to jump from number six to number four in the next three years. Business interruption is expected to drop out of the top 10 risks due to companies' efforts to improve business recovery planning.

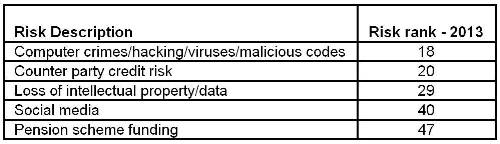

The 2013 Aon Global Risk Management Survey also uncovered several significant risks to watch, as these are perceived to be underrated risks. Aon encourages companies to increase attention on the following:

Javier Gimeno, the Aon Dirk Verbeek chaired professor in international risk and strategic management at INSEAD, reviewed Aon's survey and added, "As part of the board's responsibility to endorse and monitor strategy, directors should gain an intimate understanding of the major strategic risks, possible scenarios and how the appropriate strategy allows the exploration of uncertainties and mitigation of strategic risks. Given the results of Aon's 2013 Global Risk Management Survey, developing capabilities for strategic risk management by top management teams and boards should be an important priority in these uncertain times."

Risk decision makers are invited to participate in the survey and will receive a complimentary customized report based on their industry, geography and revenue size. To register for a copy of the Aon Global Risk Management Survey report as well as participate in the survey, visit www.aon.com/2013GlobalRisk.

About the Survey

As companies face increasing pressure from stakeholders to save costs and optimize insurance programs in this post-recession world, the 2013 Aon Global Risk Management Survey's industry- and geography-specific insights empower organizations to benchmark their risk management and risk finance practices. Benchmarking will help identify approaches that may improve the effectiveness of risk management strategies.

Methodology

Aon Risk Solutions first introduced the Aon Global Risk Management Survey report in 2007. The 2013 report reflects a survey of 1,415 organizations from 70 countries in all regions of the world, which was conducted in 10 languages in Q4 2012. The survey is still open to participants. The report was created to help risk decision makers stay abreast of emerging issues and learn how their industry and regional peers are managing risks and capturing opportunities. The web-based biannual survey addressed both qualitative and quantitative risk issues. Risk managers, CROs, CFOs, treasurers and others provided feedback and insight on their insurance and risk management choices, interests and concerns. All responses for individual organizations are kept confidential; only the consolidated data were incorporated into the report's findings.

|