The research also lists the top-ranked managers, by assets under management (AuM), in each area. Data from the broader survey (all 602 entries) shows that total global alternative AuM is now $6.2 trillion. The research shows, for the first time, the level of assets in insurance-linked investments is around $30bn, of which almost two-thirds is invested in Europe, by 13 asset managers.

Luba Nikulina, global head of manager research at Willis Towers Watson, said: “Institutional investors continue to focus on diversity but not at all cost. While inflows into alternative assets continue apace, investors have become more mindful of alignment of interests and getting value for money. This has contributed to a further blurring between individual ‘asset classes’, as investors increase their focus on underlying return drivers with the ultimate objective of achieving true diversity and making their portfolios more robust in the face of the increasingly volatile and uncertain macroeconomic environment.”

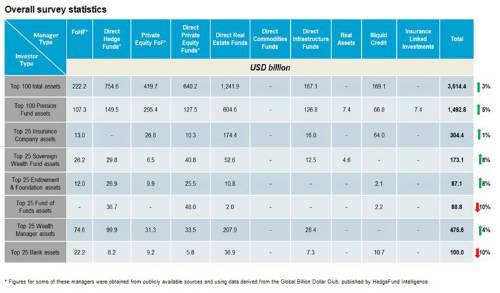

The research - which includes data on a diverse range of institutional investor types - shows that pension fund assets represent a third (34%) of the top 100 alternative managers’ assets, followed by wealth managers (19%), insurance companies (10%), sovereign wealth funds (6%), banks (2%), funds of funds (2%) and endowments & foundations (2%).

Luba Nikulina said: “The alternative asset management industry continues to be remarkably reliant on pension fund money and has earned a position of trust by delivering diversified returns via some of most highly skilled investment teams around. However, in the face of increased scrutiny on the overall value proposition from asset managers to asset owners, there is an ever-increasing demand for more alignment and lower cost. Achieving this would have a positive knock-on effect for managers of attracting assets from other investors, such as insurers and sovereign wealth funds, wanting to make the most of market volatility and associated alpha opportunities; particularly given the current lack of clear beta opportunities.”

The research shows, among the top 100 managers, that North America continues to be the largest destination for investment in alternative assets (50%), with illiquid credit and infrastructure being the only asset classes where more capital is invested in Europe. Overall, 37% of alternative assets are invested in Europe and 8% in Asia Pacific, with 5% being invested in the rest of the world.

Pension fund assets, managed by the top 100 asset managers by pension funds, increased again from the year before to reach almost $1.5 trillion. Real estate managers continue to have the largest share of pension fund assets with 40%, followed by PEFoFs (20%), hedge funds (10%), private equity (9%), infrastructure (8%), FoHFs (7%) and illiquid credit (4%).

Luba Nikulina said: “There is an increasing profusion of choice for institutional investors wishing to diversify their portfolios. A typical example of this is the increasing number of “alternative beta” strategies - such as reinsurance, carry, value, momentum, merger arbitrage - outside of the traditional hedge fund structure available for significantly lower fees and with much better alignment. There is continued interest and more options available in real estate, infrastructure and other real assets, particularly in secure income strategies where investors are searching for both yield and diversity as an alternative to traditional hedging with government debt securities. Illiquid credit, governance permitting, is another alternative way of diversifying sources of return and improving overall portfolio efficiency as part of both low risk and return-seeking portfolios.”

The survey shows that at the end of 2015, the top 25 alternative asset managers of wealth management assets managed $476bn (up 4%), followed by the top 25 managers of insurance company assets ($304bn – up 1%); the top 25 managers of sovereign wealth fund assets ($173bn – up 8%); the top 25 managers of bank assets ($100bn – down 10%); the top 25 managers of fund of funds assets ($89bn – down 10%); and the top 25 managers of endowment and foundation assets ($87bn – up 8%).

Luba Nikulina said: “The shift away from equities and bonds into alternatives has gained momentum, among most institutional investors around the world, as these strategies have helped to manage risk through diversity. Persistent economic uncertainty coupled with highly volatile conditions is likely to reinforce this trend. What is certain is that while the asset management industry as a whole faces some existential questions on whether it has delivered on its promises and how to improve its value proposition in the future, the best asset managers will continue to innovate and capture investment opportunities the volatile macro conditions produce and deliver that value to investors.”

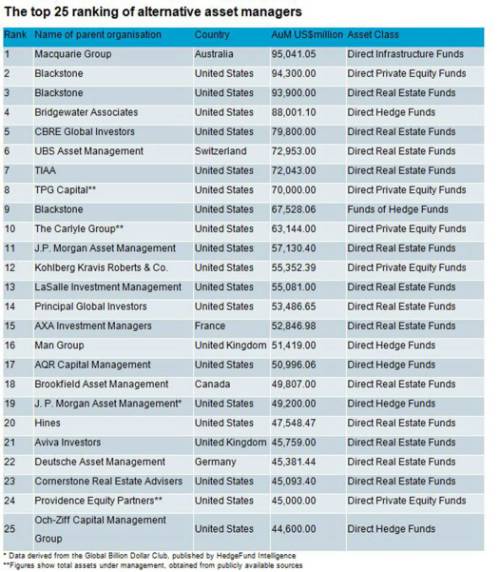

According to the research, Macquarie Group is the largest infrastructure manager with over $95bn and tops the overall rankings, while Blackstone is the largest private equity manager with over $94bn and the largest real estate manager with also almost $94bn. In the ranking Bridgewater Associates is the largest hedge fund manager with $88bn and Blackstone is the largest FoHF manager with almost $68bn. Goldman Sachs is the largest PEFoF manager with almost $45bn and M&G Investments is the largest illiquid credit manager with over $33bn. PIMCO is the largest commodities manager with $10bn, the largest manager of real assets is TIAA with over $7bn and LGT Capital Partners is the largest manager of Insurance-linked investments.

|