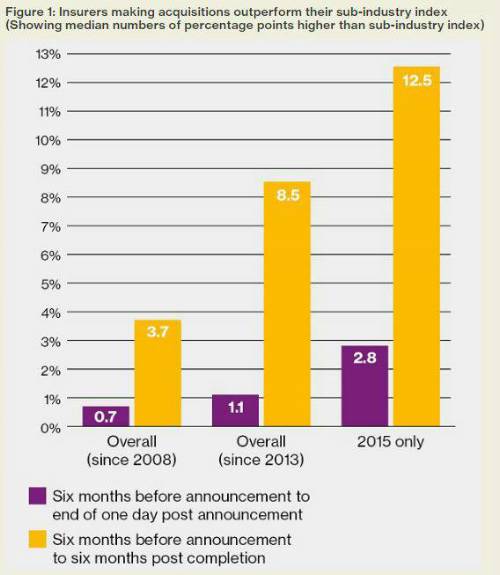

Findings from the Insurance M&A Success Tracker, based on analysis from Willis Towers Watson and Cass Business School, of all deals with a value of more than US$50m conducted since 2008, show that insurers making acquisitions delivered significantly better share price performance than their peers in the 12 months surrounding the deal.

On average, acquirers have outperformed their insurance sub-sector index by 3.7 percentage points since 2008. And this pattern has steadily become more pronounced, with acquirers outperforming their sub-index by an average of 12.5 percentage points in 2015 alone.

This trend has been driven by an outperformance in the six months following announcement. In the past three years, acquirers have traded at 1.1 percentage points higher than their index from six months before announcement to one day after, with a further 7.4 percentage points of outperformance occurring in the six months after the deal was announced. This was replicated in 2015, with 9.7 percentage points of the total outperformance happening in the second phase, against 2.8 percentage points initially.

Fergal O'Shea, EMEA Life Insurance M&A Leader at Willis Towers Watson, said: "While our figures show that these deals ultimately pay dividends, it takes time to garner results. This lack of immediate reward coupled with the uncertainty on day one around a big deal are among the reasons why investors have been slow to acknowledge the benefits of M&A in the insurance sector."

The research findings suggest there are likely to be a number of factors driving this outperformance. First, there have been a significant number of deals in the life insurance sector where firms have acquired specialist blocks of business from peers – closed life books are one example where a particular skillset is required – and then been able to add value through their expertise and experience running such assets.

"The book goes to a firm that is able to focus on it and increase value through the way in which they manage it. In effect, the same block of business is worth more under the new owner than the old one," noted Fergal O'Shea.

Another key factor driving outperformance among acquirers, according to Willis Towers Watson, has been their expansion into new territories. For example, a number of companies highlighted in the research are looking to increase their presence in emerging markets across Eastern Europe, South America and Asia.

"While there is always genuine risk and uncertainty around a deal, a certain amount of this could be assuaged if companies communicated the benefits of a deal more robustly," said Fergal O'Shea. "Insurers need a solid deal rationale that's well explained and then well executed. Both parts are essential if you are to convince shareholders."

|