|

|

There has been speculation that large numbers of people will transfer their final salary / defined benefit (“DB”) pensions into defined contribution (“DC”) plans in order to access the new range of flexibilities being introduced from 6th April 2015. They can do this by taking a “transfer value” from their DB pension scheme which would then be paid into a DC scheme. |

However, many people do not understand the potential size of their transfer value (which is linked to market conditions) and so may not be in a position to fully consider their options.

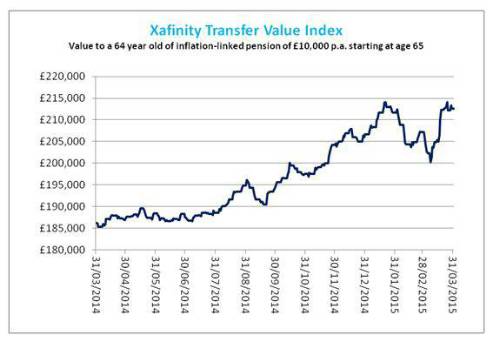

Actuaries at Xafinity therefore today launch the “Xafinity Transfer Value Index” which, on a monthly basis, will track the transfer value that would be provided by an example DB scheme to a member aged 64 who is currently entitled to a pension of £10,000 each year starting at age 65 (and which increases each year in line with inflation)*.

At the end of March 2015 the Xafinity Transfer Value Index was £213,000. Our analysis shows that the Xafinity Transfer Value Index has varied by over 15% during the last 12 months, from a minimum of around £185,000 to a maximum of around £215,000.

Paul Darlow, Head of Proposition Development at Xafinity, comments

“Transferring secure Defined Benefit pensions will not be in the best interests of most members. However it is potentially attractive to some members for whom the greater flexibility in the Defined Contribution environment outweighs the potential loss of certainty. I hope that the Xafinity Transfer Value Index will provide useful information to pension scheme members considering their retirement options. Members who are interested in transferring their benefits will need to contact their scheme to request a transfer value quotation. Any member who is thinking about transferring their benefits will need to take Independent Financial Advice, and should be aware of the dangers posed by pension scams.”

*Different schemes calculate transfer values in different ways. A given individual may therefore receive a transfer value from their scheme that is significantly different from that quoted by the Xafinity Transfer Value Index

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.