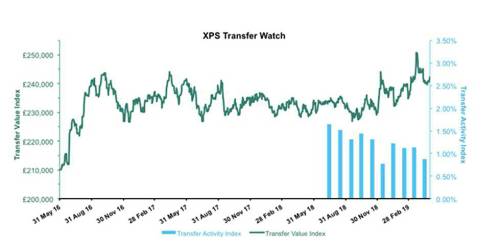

XPS’ new Transfer Watch combines our transfer value index (TVI) showing how markets impact the total payment members may get with our transfer activity index, a new index of member activity that tracks how many members are leaving schemes we look after.

Building on the success of XPS’ TVI index, XPS Transfer Watch aims to inform understanding of the trends and behaviours of members accessing new pension freedoms, and is our new monthly snapshot of the average value and number of pension transfers.

Transfer values – low yields mean transfer values remain historically high. This will continue to make it attractive for members to consider leaving their schemes. Over April 2019, pension transfer values as measured by the XPS Pensions Group Transfer Value Index fluctuated mildly, with a small fall over the month. The index was £243,900 at the end of March, and £242,300 at the end of April.

Movements in gilt yields and inflation expectations were more settled compared to March. By the end of the month gilt yields had increased (lower transfer values) slightly as had inflation expectations (higher transfer values) with the change in gilt yields being a little bit more than inflation resulting in the small reduction in values overall.

Transfer activity – numbers of transfers remain significant. Over the period of the new index typically 1% to 1.5% of eligible members (on an annualised basis) left the schemes administered by XPS each month. This may seem small but is a significant number of people. If replicated across all UK defined benefit (DB) schemes this means between 50,000 and 70,000 members are leaving schemes each year.

The index shows that there has been a steady decline in activity since mid-2018. XPS expect that this is a consequence of a slow down after a rush of transfers over 2018 due to greater member awareness and actions taken by regulators, employers and trustees to better support and protect members. However, XPS expect activity levels to remain significant going forward given the attraction of relatively large transfer values and pension freedoms. There is a significant dip in activity in December which may have been linked to schemes pausing transfer values whilst they got to grips with the complications arising from GMP equalisation.

Mark Barlow, XPS Pensions Group commented: “We are excited to launch our Transfer Watch today giving clear insights into activity. This is a key part of our focus on helping members achieve good retirement outcomes.”

XPS Transfer Watch will replace our TVI index going forward and will be issued in the second week of each month.

|