• New lease of life: 71% of over 50s feel younger than their actual age

• Living la vida loca: over 50s Brits feel on average 10 years younger than their actual age

• 50 shades of age: 1.3 million over 50s have tried online dating since turning 501

• Generous grannies: £380 million2 per month spent by over 50s on children and £262 million3 per month on grandchildren

• Perpetually parenting: Over 50s spend an estimated £675 million4 every month helping out their family financially

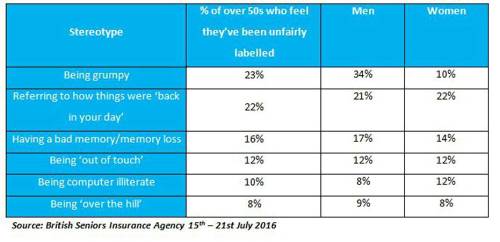

• Over the hill: Half (51%) of over 50s have been unfairly labelled as a stereotype such as grumpy or out of touch

• British Seniors Insurance Agency® provides the first Over 50s product in the UK with the Lifetime Payback

Guarantee™ as a standard product feature, this ensures that customers never receive less than the total premiums they have paid*

Despite the assumption that retiring makes you slow down, those in retirement are actually much more likely to feel youthful (72% vs 69% who are still working). Smashing stereotypes even further, over 50s in the UK are continuing to keep active with nearly half (47%) taking up hiking, and almost a fifth (17%) of 56-60 year olds joining a gym since turning 50. Over one in ten (12%) of those aged 61-65 have embraced new opportunities and started a business, despite approaching retirement, whilst almost one in seven (14%) of those aged between 71-75 have started learning a new language since turning 50.

Dave Sutherland, Managing Director of British Seniors Insurance Agency commented: “As the population keeps growing, there are more older people in the UK and the average lifestyle of someone over 50 is very different to what it used to be. It’s clear that being over 50 no longer means being ‘over the hill’, and as our research reveals, the over 50s certainly do feel young at heart. Stereotypes labelling them as grumpy, or ‘past it’ simply do not apply anymore, and society needs to re-evaluate how it views older people.”

Despite feeling younger and challenging perceptions of their age group, many over 50s in the UK are unhappy with how they are represented (38%), with nearly a quarter (27%) taking issue with their representation in the media particularly.

One in ten (10%) women said they have been labelled as being grumpy, whilst this figure more than triples for men, with 34% being labelled as such.

British Seniors Insurance Agency has found that increasingly older generations are looking for love in new places, and becoming more digitally savvy. An estimated 1.3 million1 over 50s having tried online dating since turning 50. On average the over 50s spend £41.11 online dating every month, it’s not surprising given that six per cent of older people have remarried since turning 50, showing it’s never too late to find love.

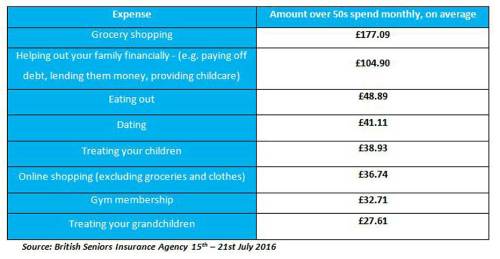

However, our research reveals that older people aren’t just spending money on themselves. The study found that older people in the UK are perpetually parenting with over 50s spending huge amounts on their children and grandchildren - with an estimated £380 million2 spent a month on treating their children and £2623 million treating their grandchildren. On average the over 50s spend nearly £40 a month treating their children and almost £30 on grandchildren. When not spoiling the younger generations, over 50s also contribute an average of £104.90 a month helping family with their day-to-day finances, which totals an estimated £675 million4 every month.

Dave Sutherland, Managing Director of British Seniors Insurance Agency commented: “Everyone loves being able to treat family members where possible and the over 50s are no different. Whether it’s gifts, days out or general help with child care, it’s a great feeling to be able to be there for your loved ones. We want to encourage people to make sure that they have some form of life insurance or cover in place so as to provide peace of mind that when the inevitable happens so they can continue helping their loved ones financially.

Our customers tell us the last thing they want when they die is for their loved ones to be left in debt paying off their funeral. That’s why at British Seniors Insurance Agency we offer great value and fully flexible Over 50s life cover –– and with the new Lifetime Payback Guarantee™ we ensure customers get full value for their hard-earned cash. We know that 79%5 of adults in the UK do not have life or funeral cover in place, and compared to the amount they are spending on loved ones, life insurance could be one of the cheapest and easiest ways to help out families financially in the long run .’’

|