In an era of evolving challenges, pension providers and wealth managers need to navigate a crucial path by upholding environmental, social, and governance (ESG) principles. The rise in younger consumers embracing sustainable investments underscores the enduring significance of ESG commitments. With climate change concerns looming and a generational wealth transfer on the horizon, adhering to green-oriented investment strategies offers not only long-term benefits but also safeguards against potential repercussions for those who neglect ESG factors, says GlobalData, a leading data and analytics company.

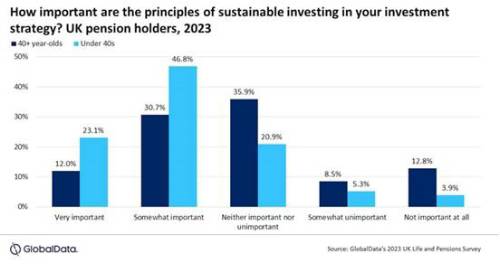

GlobalData’s 2023 UK Life and Pensions Survey reveals that younger consumers are over 50% more likely to put emphasis on sustainable investment principles. Furthermore, 69.9% of under 40s see the principles of sustainable investment as important to some extent – compared to just 42.7% of consumers aged 40 and over.

Benjamin Hatton, Insurance Analyst at GlobalData, comments: “Pension providers that maintain green-oriented investment strategies are likely to keep the business of young investors, which will only grow in size over time as the great wealth transfer looms. This younger cohort is also half as likely to consider sustainable principles as unimportant to some extent than the older generations.”

Hatton continues: “In the short-term, it may be tempting for insurers and investors to follow the money and look to renege on ESG strategies. Yet over time, this money will end up in the hands of younger generations who will not look kindly upon providers that continue to allow climate change to run rampant.”

Political discourse is also a difficult challenge for investors and insurers, most notably affecting the companies that left the Net Zero Insurance Alliance in mid-2023 citing antitrust risks. Pressures from Republican lawmakers are certainly making ESG strategy much harder to attain in the US, bringing repercussions for players across the world.

Hatton concludes: “The temperature and climate records that have tumbled in 2023 show further evidence of the devastating effects climate change is already having on the planet. Companies that turn their back on the generations this crisis will affect the most will surely see their long-term prospects diminished.”

|